Introduction

The Paywire Gateway implements different payment gateways, and offers a simple integration with an increasing number of features.

Four integration options are available:

- Application Programming Interface (API)

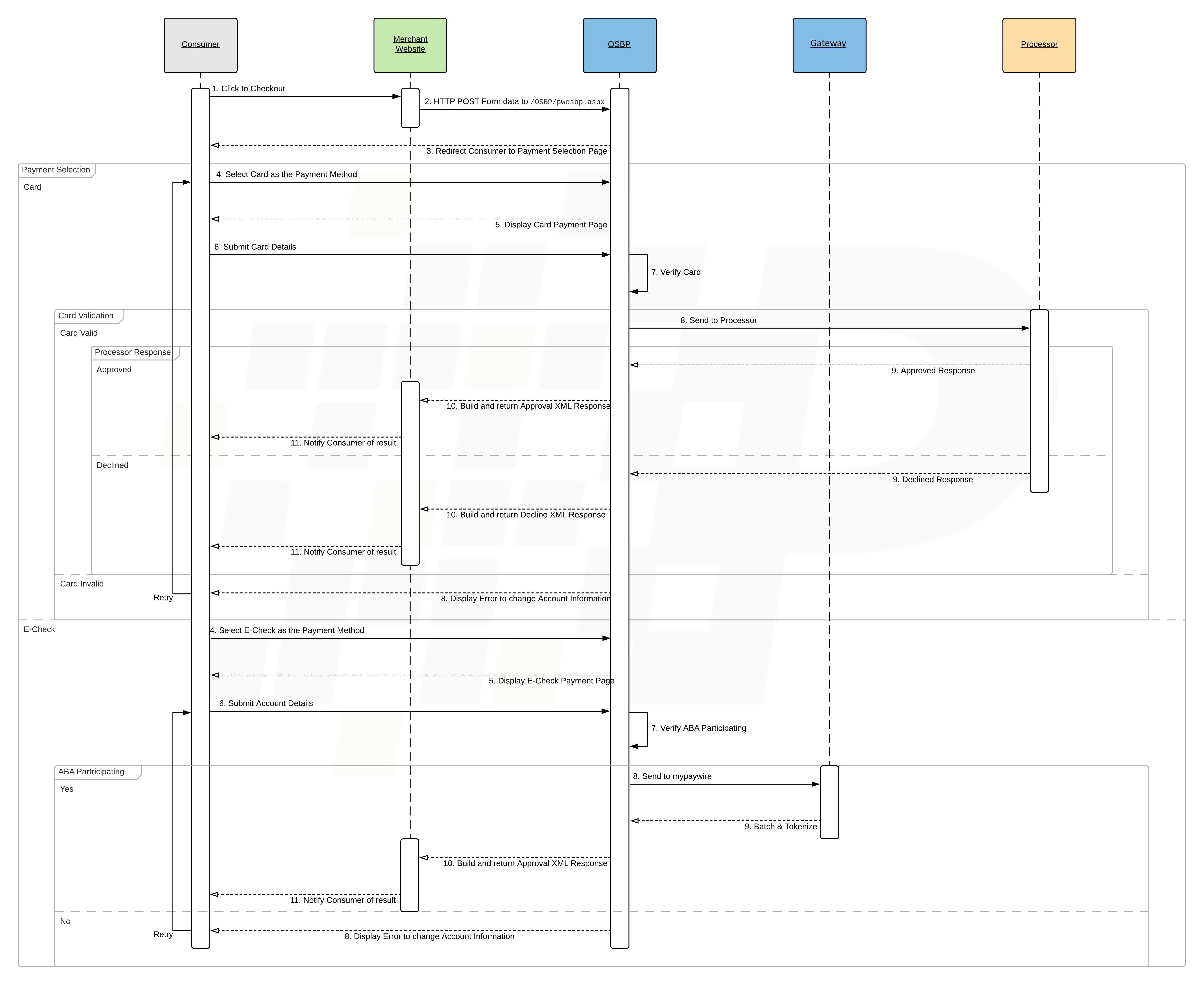

- Off Site Buy Page (OSBP)

- Checkout Page (via OSBP)

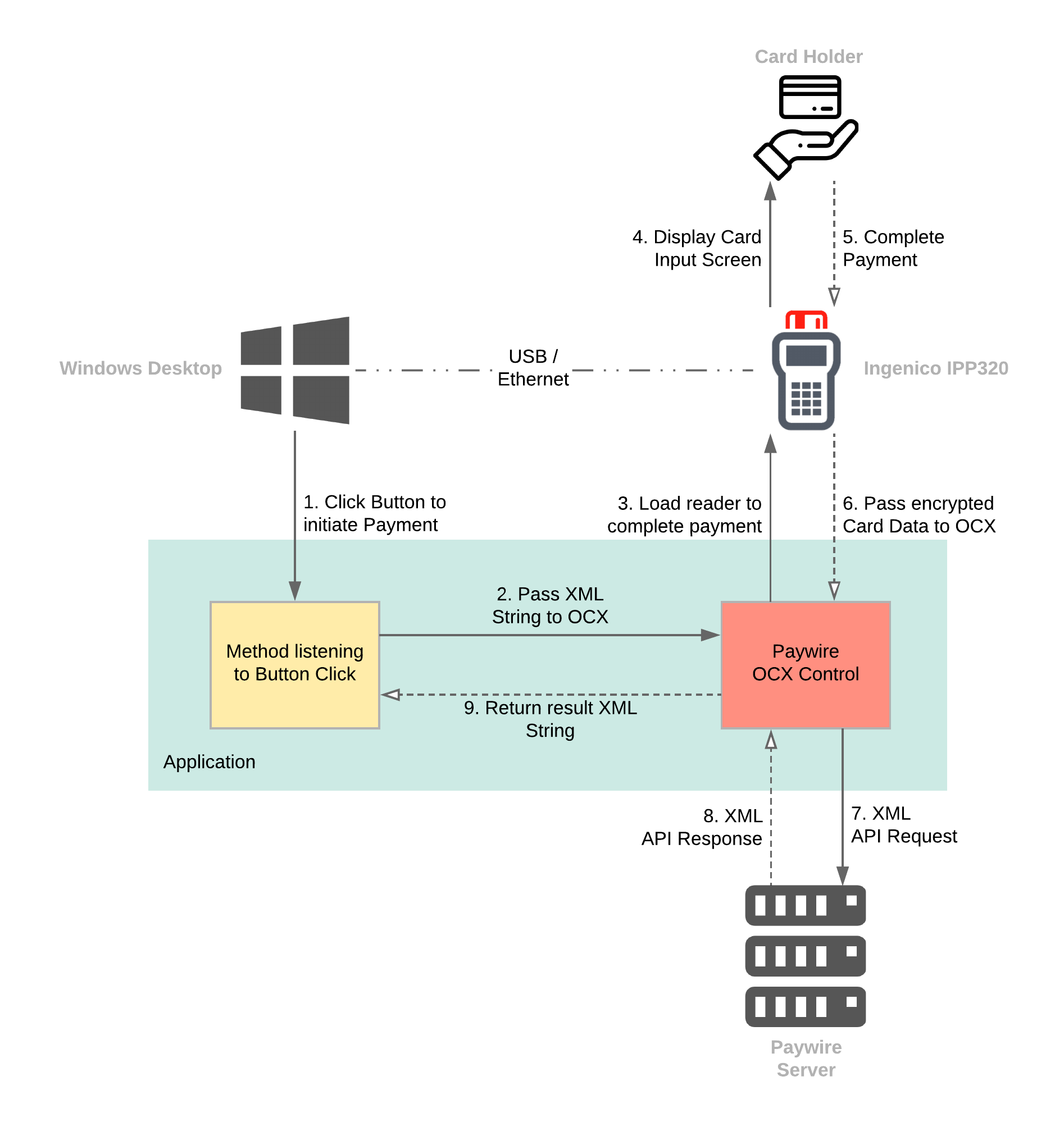

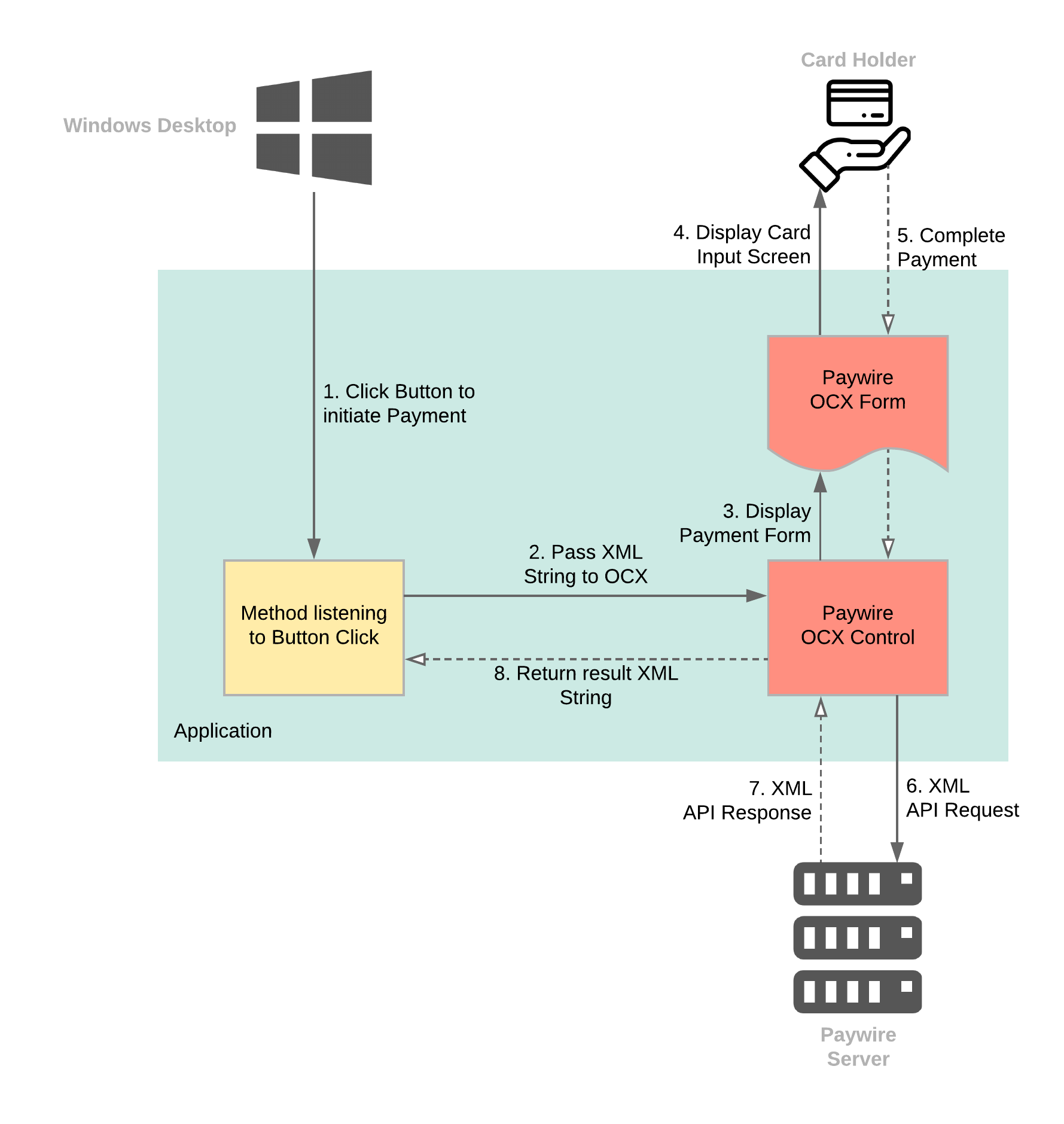

- OCX Control

The API option allows the developer to use the Paywire Gateway features within their own application. This option is the most flexible, but requires a more complex implementation. More information on the API is detailed in the API Reference.

The OSBP is the quickest integration option, favored by most merchants and developers. For more information regarding OSBP, please refer to the OSBP Reference section.

The OCX provides an easy-to-install component that can connect readers with the Paywire API or simplify integration with a built-in form that captures payment information. More information on the OCX is detailed in the OCX Reference.

URLs

The API and OSBP only accept HTTP POST.

Staging

https://dbstage1.paywire.com

Production

https://dbtranz.paywire.com

Authentication

API/OCX Example:

<PAYMENTREQUEST>

<TRANSACTIONHEADER>

<PWCLIENTID>{clientId}</PWCLIENTID>

<PWKEY>{key}</PWKEY>

<PWUSER>{username}</PWUSER>

<PWPASS>{password}</PWPASS>

...

</TRANSACTIONHEADER>

...

</PAYMENTREQUEST>

Make sure to replace

{clientId},{key},{username}and{password}with the relevant credentials provided to you by the administrator.

To authenticate with the Paywire API or OCX, simply include your 4 credentials in the XML payload.

If you do not have these credentials you may request them by emailing support@payscout.com.

OSBP Example:

<PAYMENTREQUEST>

<TRANSACTIONHEADER>

<PWCLIENTID>{clientId}</PWCLIENTID>

<PWKEY>{key}</PWKEY>

<AUTHTOKEN>4C2F8EE94CA2491AAB67EA6541CB17BA</AUTHTOKEN>

...

</TRANSACTIONHEADER>

...

</PAYMENTREQUEST>

To authenticate with the OSBP, first request a Get Auth Token to retrieve an AUTHTOKEN, then submit it as a request parameter instead of PWUSER and PWPASS.

Common Structure

XML Requests

Common Request XML Elements:

<PAYMENTREQUEST>

<TRANSACTIONHEADER>

<PWVERSION>3</PWVERSION>

<PWCLIENTID></PWCLIENTID>

<PWKEY></PWKEY>

<PWUSER></PWUSER>

<PWPASS></PWPASS>

<PWTRANSACTIONTYPE></PWTRANSACTIONTYPE>

</TRANSACTIONHEADER>

<CUSTOMER/>

</PAYMENTREQUEST>

The API, OSBP and OCX (using form) all have a similar XML request structure.

PAYMENTREQUEST is the parent element to a TRANSACTIONHEADER block, and a CUSTOMER block when processing a payment.

TRANSACTIONHEADER needs to always specify the Authentication, PWTRANSACTIONTYPE and PWVERSION parameters as children.

XML Responses

OSBP Approved Response Example:

<?xml version="1.0" encoding="UTF-8"?>

<PAYMENTRESPONSE>

<PWINVOICENUMBER>0987654321234567889</PWINVOICENUMBER>

<RESULT>APPROVAL</RESULT>

<PWCLIENTID>0000000001</PWCLIENTID>

<AUTHCODE>TAS709</AUTHCODE>

<AVSCODE>N</AVSCODE>

<CVVCODE>M</CVVCODE>

<PAYMETH>C</PAYMETH>

<PWUNIQUEID>596</PWUNIQUEID>

</PAYMENTRESPONSE>

API Approved Response Example:

<?xml version="1.0" encoding="UTF-8"?>

<PAYMENTRESPONSE>

<RESULT>APPROVAL</RESULT>

<BATCHID>1</BATCHID>

<PWCLIENTID>0000000001</PWCLIENTID>

<PAYMETH>A</PAYMETH>

<PWUNIQUEID>112302</PWUNIQUEID>

<AHNAME>John Doe</AHNAME>

<AMOUNT>10.00</AMOUNT>

<MACCOUNT>XXXXXX4082</MACCOUNT>

<EMAIL>jd@example.com</EMAIL>

<CCTYPE>ACH</CCTYPE>

<PWINVOICENUMBER>0987654321234567890</PWINVOICENUMBER>

</PAYMENTRESPONSE>

OSBP Declined Response Example:

<?xml version="1.0" encoding="UTF-8"?>

<PAYMENTRESPONSE>

<PWINVOICENUMBER>0987654321234567889</PWINVOICENUMBER>

<RESULT>DECLINED</RESULT>

<RESTEXT>CVV2 MISMATCH</RESTEXT>

<PWCLIENTID>0000000001</PWCLIENTID>

<CVVCODE>N</CVVCODE>

<PAYMETH>C</PAYMETH>

<PWUNIQUEID>597</PWUNIQUEID>

</PAYMENTRESPONSE>

API Declined Response Example:

<?xml version="1.0" encoding="UTF-8"?>

<PAYMENTRESPONSE>

<RESULT>DECLINED</RESULT>

<RESTEXT> ERROR 0295 </RESTEXT>

<BATCHID>1</BATCHID>

<PWCLIENTID>0000000001</PWCLIENTID>

<AVSCODE>0</AVSCODE>

<PAYMETH>C</PAYMETH>

<PWUNIQUEID>112301</PWUNIQUEID>

<AHNAME>John Doe</AHNAME>

<AMOUNT>10.00</AMOUNT>

<MACCOUNT>XXXXXXXXXXXX1111</MACCOUNT>

<EMAIL>jd@example.com</EMAIL>

<CCTYPE>VISA</CCTYPE>

<PWINVOICENUMBER>0987654321234567890</PWINVOICENUMBER>

</PAYMENTRESPONSE>

The following XML parameters are returned by the OSBP, API, and the OCX when using the UI form:

| Parameter | Type | Description |

|---|---|---|

| PWCLIENTID | int | ID associated with merchant. |

| PWINVOICENUMBER | string | The Merchant's unique invoice number submitted in the transaction request. |

| RESULT | string | The result of the transaction: APPROVAL, SUCCESS, DECLINED, ERROR. |

| RESTEXT | string | Contains the error message. |

| AMOUNT | int/decimal | Amount of the transaction total including any adjustments and taxes. Maximum 7 digits, excluding decimals. |

| PWADJDESC | string | 'Consumer Fee'-enabled merchants only: The description for the service adjustment as set in the merchant configuration. |

| PWADJAMOUNT | int/decimal | 'Consumer Fee'-enabled merchants only: Amount of the service adjustment. Maximum 7 digits, excluding decimals. |

| PWSALETAX | int/decimal | 'Consumer Fee'-enabled merchants only: Amount of the sales tax calculated based on the 'Sales Tax Flat Rate %' set in the merchant configuration. Maximum 7 digits, excluding decimals. |

| PWSALEAMOUNT | int/decimal | Original Sale Amount, before any markups or discounts. Max 7 digits, excluding decimals. |

| MASKEDACCOUNTNUMBER | string | The masked account number under which the transaction was processed. |

| PAYMETH | string | Method of payment with which the transaction was processed: E for web ACH, C for Card. |

| CCTYPE | string | The card type used. This field is blank if PAYMETH is E. |

| AHNAME | string | The account holder's name that was supplied. |

| AHFIRSTNAME | string | The account holder's first name that was supplied. |

| AHLASTNAME | string | The account holder's last name that was supplied. |

| PWUNIQUEID | string | The unique ID assigned by Paywire associated with this transaction. |

| string | The user's email address that was supplied at the start of the transaction. | |

| AUTHCODE | string | Authorization code associated with the transaction, if applicable. |

| PWCID | string | Paywire Customer Identifier associated with a transaction. If the original request was to create a customer, then this will be the new customer ID. |

| AVSCODE | string | Transaction AVS code result. Refer to AVS Codes table. |

| CVVCODE | int | Transaction CVV result: 1 for a match, 0 for a failure. |

| RECURRING | int | The periodic amount if the value under PWCTRANSTYPE is selected. |

Test Cards

The following are available for you to test with the Paywire gateway:

| Card Scheme | Number | CVV |

|---|---|---|

| VISA | 4761739001010267 | 999 |

| Mastercard | 5413330089010608 | 998 |

| Discover | 6510000000000034 | 996 |

| TSYS | 4012000098765439 | 123 |

| FirstData | 5413330089010608 | 123 |

| MES | 5413330089010608 | 123 |

| JCB | 3566000021111117 | 123 |

| Diners | 36185900022226 | 123 |

| Account Type | Routing Number | Account Number | Used for |

|---|---|---|---|

| Current/Savings | 222224444 | 222224444 or any same digit number | For Regular Testing |

| Current/Savings | 11000028 | 11111111111111111 | For ME merchants |

| Current/Savings | 121140399 | 3300674738 | For ME merchants |

| Current/Savings | 121140399 | 3300674723 | For ME merchants |

ACH Bank Details for generating Verify Decline Codes

The following are Routing/Account combinations to generate ACH Verify Decline Codes: ACH Verify Decline Codes.

| Account Type | Routing Number | Account Number | ResultCode |

|---|---|---|---|

| Current/Savings | 061000052 | 999999991 | AVC1 |

| Current/Savings | 061000052 | 999999992 | AVC2 |

| Current/Savings | 061000052 | 999999993 | AVC3 |

| Current/Savings | 061000052 | 999999994 | AVC4 |

| Current/Savings | 061000052 | 999999995 | AVC5 |

| Current/Savings | 061000052 | 999999996 | AVC6 |

| Current/Savings | 061000052 | 999999997 | AVC7 |

| Current/Savings | 061000052 | 999999998 | AVC8 |

| Current/Savings | 061000052 | 999999999 | AVC9 |

| Current/Savings | 061000052 | 999999910 | AVC10 |

| Current/Savings | 061000052 | 999999990 | AVC0 |

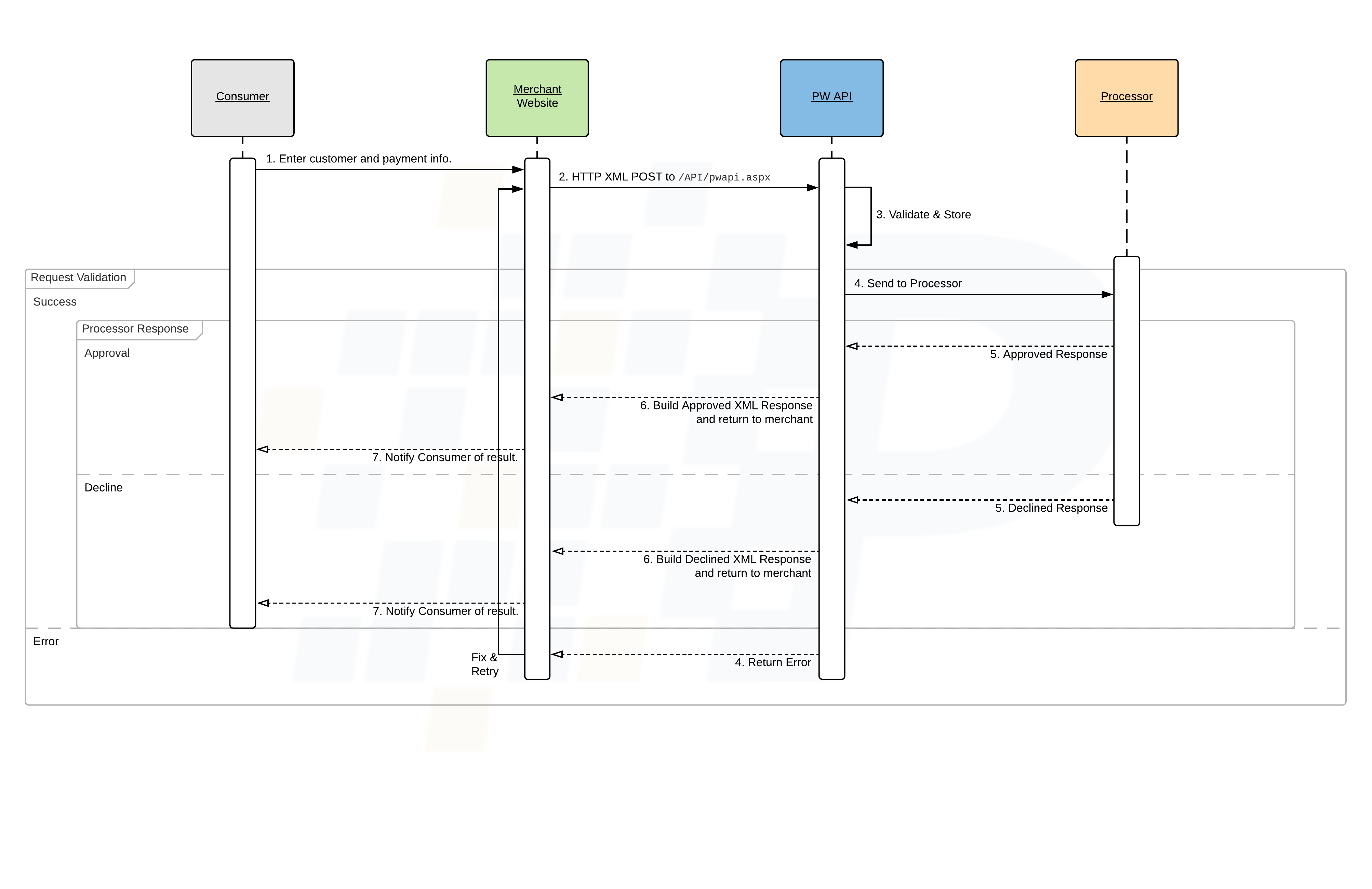

API Reference

The Application Programming Interface ("API") is the alternate subroutine interface to the Off Site Buy Page (OSBP). The API is primarily used by clients who wish to add payment acceptance methods to their existing application.

Currently, the Paywire API accepts requests in XML using HTTP POST only.

API Overview

Source Code Example:

protected string pwPost(string url, string xmlPayload)

{

HttpWebRequest req;

HttpWebResponse res;

try

{

req = (HttpWebRequest)WebRequest.Create(url);

req.Method = "POST";

req.ContentType = "text/xml; charset=utf-8";

req.ContentLength = xmlPayload.Length;

var sw = new StreamWriter(req.GetRequestStream());

sw.Write(xmlPayload);

sw.Close();

res = (HttpWebResponse)req.GetResponse();

Stream responseStream = res.GetResponseStream();

var streamReader = new StreamReader(responseStream);

//Read the response into an xml document

var xml = new XmlDocument();

xml.LoadXml(streamReader.ReadToEnd());

var result = xml.InnerXml;

return result;

}

catch (Exception ex)

{

throw;

}

}

Private Function sendRequest(ByVal url As string, ByVal xmlPayload As string) As string

Dim request As WebRequest = WebRequest.Create(url)

Dim result As string = string.Empty

request.Method = "POST"

request.ContentLength = xmlPayload.Length

request.ContentType = "text/xml"

Dim writer As New StreamWriter(request.GetRequestStream(), System.Text.Encoding.UTF8)

writer.Write(base64Encode(xmlPayload))

writer.Close()

Dim stream As Stream = request.GetResponse().GetResponseStream()

Dim reader As New StreamReader(stream)

Dim response As string = string.Empty

response = reader.ReadToEnd()

response = Server.UrlDecode(response)

Return base64Decode(response)

End Function

Public Function base64Encode(ByVal data As string) As string

Try

Dim encData_byte As Byte() = New Byte(data.Length - 1) {}

encData_byte = System.Text.Encoding.UTF8.GetBytes(data)

Dim encodedData As string = Convert.ToBase64string(encData_byte)

Return encodedData

Catch e As Exception

Throw New Exception("Error in base64Encode" + e.Message)

End Try

End Function

Public Function base64Decode(ByVal data As string) As string

Try

Dim encoder As New System.Text.UTF8Encoding()

Dim utf8Decode As System.Text.Decoder = encoder.GetDecoder()

Dim todecode_byte As Byte() = Convert.FromBase64string(data)

Dim charCount As Integer = utf8Decode.GetCharCount(todecode_byte, 0, todecode_byte.Length)

Dim decoded_char As Char() = New Char(charCount - 1) {}

utf8Decode.GetChars(todecode_byte, 0, todecode_byte.Length, decoded_char, 0)

Dim result As string = New [string](decoded_char)

Return result

Catch e As Exception

Throw New Exception("Error in base64Decode" + e.Message)

End Try

End Function

$ curl

https://dbstage1.paywire.com/API/pwapi

-X POST

-H "Content-Type: text/xml"

-d "$XML_Payload"

xmlPayloadis the only variable between different transaction types.

To use the Paywire API you will need to:

- Implement logic in your application to determine the transaction type required.

- Collect the necessary information from the customer (where applicable), which may include PCI data.

- Build an XML string including authentication parameters and (at a minimum) mandatory fields for the transaction type being processed.

- Send an HTTP POST containing the XML string to the Paywire API endpoint.

- Receive an XML response to parse and use.

API Endpoints

The same OSBP endpoint is available for all requests, across all environments:

POST /API/pwapi

Content-Type: text/xml

API Transaction Types

The following transactions can be processed via the Paywire API.

Simply submit the relevant value in PWTRANSACTIONTYPE, along with the required XML parameters.

| Value | Description |

|---|---|

| SALE | Charge a card or bank account (if applicable). |

| VOID | Void a transaction. The transaction amount must match the amount of the original transaction, and the PWUNIQUEID must match the unique identifier associated with the transaction to void. The transaction must be in the current open batch to void it. |

| CREDIT | Credit a transaction. The transaction amount must be equal to or less than the amount to credit, and the PWUNIQUEID must match the unique identifier associated with the transaction to credit. Only transactions in a closed batch with a status of SETTLED can be credited. |

| PREAUTH | Pre-authorize a card. |

| GETAUTHTOKEN | Exchange your credentials for an AUTHTOKEN to use when calling the OSBP. |

| GETCONSUMERFEE | Input the sale amount to get adjustment, tax, and total transaction amounts. Relevant for merchants configured with Cash Discount or Convenience Fees. |

| CREATECUSTOMER | Creates a Customer in the Paywire Vault. |

| GETCUSTOKENS | Lists tokens stored against a given customer. |

| STORETOKEN | Validate a card and return a token. |

| REMOVETOKEN | Delete an existing token from Paywire. |

| VERIFICATION | Verification transaction will verify the customer's card or bank account before submitting the payment. |

| BATCHINQUIRY | Get the current open batch summary. |

| CLOSE | Close the current open batch. |

| SEARCHTRANS | Query the database for transaction results. |

| GETPERIODICPLAN | Query the database for periodic plan details using RECURRINGID, PWTOKEN or PWCID. |

| DELETERECURRING | Delete a periodic plan. |

| SENDRECEIPT | Sends a receipt for a given transaction. |

API One-Time-Sale

Card Request Example:

<?xml version="1.0" encoding="UTF-8"?>

<PAYMENTREQUEST>

<TRANSACTIONHEADER>

<PWVERSION>3</PWVERSION>

<PWCLIENTID>{clientId}</PWCLIENTID>

<PWKEY>{key}</PWKEY>

<PWUSER>{username}</PWUSER>

<PWPASS>{password}</PWPASS>

<PWTRANSACTIONTYPE>SALE</PWTRANSACTIONTYPE>

<PWSALEAMOUNT>10</PWSALEAMOUNT>

<PWINVOICENUMBER>0987654321234567890</PWINVOICENUMBER>

</TRANSACTIONHEADER>

<CUSTOMER>

<COMPANYNAME>The Company</COMPANYNAME>

<FIRSTNAME>John</FIRSTNAME>

<LASTNAME>Doe</LASTNAME>

<EMAIL>jd@example.com</EMAIL>

<ADDRESS1>1 The Street</ADDRESS1>

<CITY>New York</CITY>

<STATE>NY</STATE>

<ZIP>12345</ZIP>

<COUNTRY>US</COUNTRY>

<PRIMARYPHONE>1234567890</PRIMARYPHONE>

<WORKPHONE>1234567890</WORKPHONE>

<PWMEDIA>CC</PWMEDIA>

<CARDNUMBER>4111111111111111</CARDNUMBER>

<EXP_MM>02</EXP_MM>

<EXP_YY>22</EXP_YY>

<CVV2>123</CVV2>

</CUSTOMER>

</PAYMENTREQUEST>

E-Check Request Example:

<?xml version="1.0" encoding="UTF-8"?>

<PAYMENTREQUEST>

<TRANSACTIONHEADER>

<PWVERSION>3</PWVERSION>

<PWCLIENTID>{clientId}</PWCLIENTID>

<PWKEY>{key}</PWKEY>

<PWUSER>{username}</PWUSER>

<PWPASS>{password}</PWPASS>

<PWTRANSACTIONTYPE>SALE</PWTRANSACTIONTYPE>

<PWSALEAMOUNT>10</PWSALEAMOUNT>

<PWINVOICENUMBER>0987654321234567890</PWINVOICENUMBER>

</TRANSACTIONHEADER>

<CUSTOMER>

<COMPANYNAME>The Company</COMPANYNAME>

<FIRSTNAME>John</FIRSTNAME>

<LASTNAME>Doe</LASTNAME>

<EMAIL>jd@example.com</EMAIL>

<ADDRESS1>1 The Street</ADDRESS1>

<CITY>New York</CITY>

<STATE>NY</STATE>

<ZIP>12345</ZIP>

<COUNTRY>US</COUNTRY>

<PRIMARYPHONE>1234567890</PRIMARYPHONE>

<WORKPHONE>1234567890</WORKPHONE>

<PWMEDIA>ECHECK</PWMEDIA>

<BANKACCTTYPE>CHECKING</BANKACCTTYPE>

<ROUTINGNUMBER>222224444</ROUTINGNUMBER>

<ACCOUNTNUMBER>4242204082</ACCOUNTNUMBER>

</CUSTOMER>

</PAYMENTREQUEST>

Approved Response Example:

<?xml version="1.0" encoding="UTF-8"?>

<PAYMENTRESPONSE>

<RESULT>APPROVAL</RESULT>

<BATCHID>1</BATCHID>

<PWCLIENTID>0000000001</PWCLIENTID>

<PAYMETH>A</PAYMETH>

<PWUNIQUEID>112302</PWUNIQUEID>

<AHNAME>John Doe</AHNAME>

<AMOUNT>10.00</AMOUNT>

<MACCOUNT>XXXXXX4082</MACCOUNT>

<EMAIL>jd@example.com</EMAIL>

<CCTYPE>ACH</CCTYPE>

<PWINVOICENUMBER>0987654321234567890</PWINVOICENUMBER>

</PAYMENTRESPONSE>

Declined Response Example:

<?xml version="1.0" encoding="UTF-8"?>

<PAYMENTRESPONSE>

<RESULT>DECLINED</RESULT>

<RESTEXT> ERROR 0295 </RESTEXT>

<BATCHID>1</BATCHID>

<PWCLIENTID>0000000001</PWCLIENTID>

<AVSCODE>0</AVSCODE>

<PAYMETH>C</PAYMETH>

<PWUNIQUEID>112301</PWUNIQUEID>

<AHNAME>John Doe</AHNAME>

<AMOUNT>10.00</AMOUNT>

<MACCOUNT>XXXXXXXXXXXX1111</MACCOUNT>

<EMAIL>jd@example.com</EMAIL>

<CCTYPE>VISA</CCTYPE>

<ISDEBIT>TRUE</ISDEBIT>

<PWINVOICENUMBER>0987654321234567890</PWINVOICENUMBER>

</PAYMENTRESPONSE>

RCC - Remotely Created Checks Request Example:

<?xml version="1.0" encoding="UTF-8"?>

<PAYMENTREQUEST>

<TRANSACTIONHEADER>

<PWVERSION>3</PWVERSION>

<PWCLIENTID>{clientId}</PWCLIENTID>

<PWKEY>{key}</PWKEY>

<PWUSER>{username}</PWUSER>

<PWPASS>{password}</PWPASS>

<PWTRANSACTIONTYPE>SALE</PWTRANSACTIONTYPE>

<PWSALEAMOUNT>10.00</PWSALEAMOUNT>

<CARDPRESENT>FALSE</CARDPRESENT>

</TRANSACTIONHEADER>

<CUSTOMER>

<REQUESTTOKEN>FALSE</REQUESTTOKEN>

<PWMEDIA>ECHECK</PWMEDIA>

<BANKACCTTYPE>CHECKING</BANKACCTTYPE>

<SECCODE>ICL</SECCODE>

<ROUTINGNUMBER>222224444</ROUTINGNUMBER>

<ACCOUNTNUMBER>4242204082</ACCOUNTNUMBER>

<FIRSTNAME>John</FIRSTNAME>

<LASTNAME>Doe</LASTNAME>

<ADDRESS1>1 The Street</ADDRESS1>

<ADDRESS2></ADDRESS2>

<CITY>New York</CITY>

<STATE>NY</STATE>

<COUNTRY>US</COUNTRY>

<ZIP>12345</ZIP>

</CUSTOMER>

</PAYMENTREQUEST>

RCC - Remotely Created Checks Approved Response Example:

<?xml version="1.0" encoding="UTF-8"?>

<PAYMENTRESPONSE>

<RESULT>APPROVAL</RESULT>

<BATCHID>1</BATCHID>

<PWCLIENTID>0000000001</PWCLIENTID>

<PAYMETH>A</PAYMETH>

<PWUNIQUEID>112302</PWUNIQUEID>

<AHNAME>John Doe</AHNAME>

<PWSALETAX>0.00</PWSALETAX>

<PWADJAMOUNT>0.00</PWADJAMOUNT>

<PWSALEAMOUNT>10.00</PWSALEAMOUNT>

<AMOUNT>10.00</AMOUNT>

<MACCOUNT>XXXXX6789</MACCOUNT>

<CCTYPE>ACH</CCTYPE>

<PWINVOICENUMBER>0987654321234567890</PWINVOICENUMBER>

</PAYMENTRESPONSE>

To process a Sale transaction, submit SALE in the <PWTRANSACTIONTYPE /> parameter along with the mandatory fields.

A SALE transaction now supports RCC: Remotely Created Checks.

Remotely Created Checks, or RCC, is a broad term used to describe processing which clears transactions through a bank-to-bank file transfer rather than through the ACH network.

Both RCC and ACH are used for web and phone transactions as well as one-time and recurring debits from bank accounts.

The customer experience for RCC and ACH is the same for the most part.

From the merchant's perspective, the process is almost identical.

| Parameter | Required | Type | Description | Validation |

|---|---|---|---|---|

| PWVERSION | ✓ |

int | The Paywire Gateway version number. | 3 |

| PWTRANSACTIONTYPE | ✓ |

string | Defines what transaction to process. | SALE |

| PWSALEAMOUNT | ✓ |

int/decimal | Amount of the transaction. | |

| PWINVOICENUMBER | string | Merchant’s unique invoice number to be associated with this transaction. If not submitted, this will be generated by the gateway and returned in the XML response. | 0/20, Alphanumeric |

|

| PWMEDIA | ✓ |

string | Defines the payment method. | Fixed options: CC and ECHECK. |

| CARDNUMBER | (✓) |

int | Card number to process payment with. Required only when CC is submitted in PWMEDIA. |

|

| EXP_MM | (✓) |

string | Card expiry month. Required only when CC is submitted in PWMEDIA. |

2/2, >0, <=12 |

| EXP_YY | (✓) |

string | Card expiry year. Required only when CC is submitted in PWMEDIA. |

2/2 |

| CVV2 | (✓) |

int | Card Verification Value. Required only when CC is submitted in PWMEDIA. |

3/4 |

| BANKACCTTYPE | (✓) |

string | Type of Bank Account to process payment with. Required only when ECHECK is submitted in PWMEDIA. |

CHECKING, SAVINGS |

| ROUTINGNUMBER | (✓) |

string | Routing number of Bank Account to process payment with. Required only when ECHECK is submitted in PWMEDIA. |

|

| ACCOUNTNUMBER | (✓) |

string | Account number of Bank Account to process payment with. Required only when ECHECK is submitted in PWMEDIA. |

|

| ADDCUSTOMER | bool | Creates a customer and an associated token and returns a PWCID and a PWTOKEN in the response when set to TRUE. Overrides REQUESTTOKEN if also submitted. |

||

| REQUESTTOKEN | bool | Creates a token and returns a PWTOKEN in the response when set to TRUE. By default, when not submitted, a PWTOKEN is returned when CC is submitted in PWMEDIA but not for ECHECK. |

||

| PWCID | string | Paywire Customer Identifier. If REQUESTTOKEN is also submitted as TRUE, the created token will be associated with this customer. |

||

| PWTOKEN | string | Unique token representing a customer's card or account details stored on the Paywire Gateway. Use instead of submitting CARDNUMBER, EXP_MM, EXP_YY and CVV2 or ROUTINGNUMBER and ACCOUNTNUMBER. |

||

| CUSTOMERNAME | string | Full name of the customer, possibly different to the Account Holder. | ||

| FIRSTNAME | string | Account Holder's first name (required for RCC). | ||

| LASTNAME | string | Account Holder's last name (required for RCC). | ||

| COMPANYNAME | string | Customer's company name. | ||

| ADDRESS1 | string | Account Holder's primary address (required for RCC). | ||

| ADDRESS2 | string | Account Holder's secondary address (required for RCC). | ||

| CITY | string | Account Holder's city of residence (required for RCC). | ||

| STATE | (✓) |

string | Account Holder's state of residence. Required if configured with Convenience Fees (required for RCC). | |

| COUNTRY | string | Account Holder's country of residence (required for RCC). | ||

| ZIP | string | Account Holder's address postal/zip code (required for RCC) See important note on Zip Codes. | ||

| string | Account Holder's email address. | |||

| PRIMARYPHONE | string | Account Holder's primary phone number. | ||

| WORKPHONE | string | Account Holder's work phone number. | ||

| DISABLECF | bool | Overrides applying a Convenience Fee or Cash Discount when set to TRUE, if configured. Note that Sales Tax will also be disabled. |

Default: FALSE |

|

| ADJTAXRATE | decimal | Overrides the configured Sales Tax rate. | ||

| PWCUSTOMID1 | string | Custom third-party ID to be associated with this transaction. | ||

| PWRECEIPTDESC | string | Extra information to be displayed on the receipt. | 0/200 |

|

| PWCASHIERID | string | Paywire-assigned cashier identifier. | ||

| SECCODE | string | SEC Code for ECHECK payments. | 3/3 ICL (for RCC) |

|

| DESCRIPTION | string | Transaction custom description message. | 0/100 |

Sale Response Parameters

| Parameter | Type | Description | Options | |

|---|---|---|---|---|

| RESULT | string | Transaction Result | APPROVAL , DECLINED ,ERROR |

|

| RESTEXT | string | Transaction response message. | ||

| BATCHID | string | Transaction batch ID. | ||

| PWCLIENTID | string | Authentication credential provided to you by the administrator. | ||

| PAYMETH | string | Method of payment that the transaction was processed with: E for web ACH, C for Card. |

||

| PWUNIQUEID | string | The unique ID of the transaction. | ||

| AHNAME | string | The full name of the account holder. | ||

| AHFIRSTNAME | string | The first name of the account holder. | ||

| AHLASTNAME | string | The last name of the account holder. | ||

| PWADJAMOUNT | decimal | The adjustment amount of the transaction, applicable to Convenience Fee and Cash Discount transactions. | ||

| AMOUNT | decimal | The total approved amount of the transaction, including any adjustments. | ||

| MACCOUNT | string | The masked account number. | ||

| CCTYPE | string | For card payment, this is the cardbrand, for ACH payment, it is always ACH |

VISA,

MC,

DISC,

AMEX,

CUP,

JCB,

DINERS,

ACH

|

|

| PWINVOICENUMBER | string | The merchants unique invoice number associated with this transaction. | ||

| PWTOKEN | string | The payment token for the payment method. | ||

| PWCID | string | The customer ID. | ||

| RECURRINGID | string | The plan UID for periodic payment plan. | ||

| AUTHCODE | string | The auth code from the processor. | ||

| AVSCODE | string | The AVS Response code from the processor. | ||

| CVVCODE | string | The CVV Response code from the processor. | ||

| ISDEBIT | Bool | Indicate if the card is a debit or credit card. | TRUE/FALSE |

API Periodic Sale

Request Example:

<PAYMENTREQUEST>

<TRANSACTIONHEADER>

...

</TRANSACTIONHEADER>

<CUSTOMER>

...

</CUSTOMER>

<RECURRING>

<STARTON>2018-01-01</STARTON>

<PAYMENTTOTAL>1234.5</PAYMENTTOTAL>

<FREQUENCY>W</FREQUENCY>

<PAYMENTS>4</PAYMENTS>

</RECURRING>

</PAYMENTREQUEST>

For brevity, parameters identical to the One-Time-Sale XML request structure have been summarized by

...Approved Response Example:

<?xml version="1.0" encoding="UTF-8"?>

<PAYMENTRESPONSE>

<RESULT>APPROVAL</RESULT>

<BATCHID>1</BATCHID>

<PWCLIENTID>000000001</PWCLIENTID>

<AUTHCODE>012345</AUTHCODE>

<AVSCODE>R</AVSCODE>

<PAYMETH>C</PAYMETH>

<PWUNIQUEID>100896</PWUNIQUEID>

<AHNAME>John Doe</AHNAME>

<AMOUNT>10.00</AMOUNT>

<MACCOUNT>XXXXXXXXXXXX1111</MACCOUNT>

<EMAIL>jd@example.com</EMAIL>

<CCTYPE>VISA</CCTYPE>

<PWINVOICENUMBER>0987654321234567891</PWINVOICENUMBER>

<RECURRINGID>113</RECURRINGID>

</PAYMENTRESPONSE>

Declined Response Example:

<?xml version="1.0" encoding="UTF-8"?>

<PAYMENTRESPONSE>

<RESULT>ERROR</RESULT>

<RESTEXT>Invalid PAYMENTS</RESTEXT>

</PAYMENTRESPONSE>

This request demonstrates the functioning of Payment Total, the Payment total Amount is 120 and the sale amount is 50 with 2 payments, in the first payment, the sale will be 50, in the 2nd it will be 70.

<PAYMENTREQUEST>

<TRANSACTIONHEADER>

...

</TRANSACTIONHEADER>

<CUSTOMER>

...

<PWSALEAMOUNT>50</PWSALEAMOUNT>

...

</CUSTOMER>

<RECURRING>

<STARTON>2018-01-01</STARTON>

<PAYMENTTOTAL>120</PAYMENTTOTAL>

<FREQUENCY>W</FREQUENCY>

<PAYMENTS>2</PAYMENTS>

</RECURRING>

</PAYMENTREQUEST>

In order to create a Periodic setup, simply include the <RECURRING> block in addition to the One-Time-Sale parameters.

| Parameter | Required | Type | Description | Validation |

|---|---|---|---|---|

| STARTON | ✓ |

Date | Date the first payment must be charged. | Date Format yyyy-mm-dd. |

| PAYMENTTOTAL | Int/Decimal | Payment Total Amount of Periodic transaction, Users can utilize this field if the recurring total cannot be divided by the payment count. | Paymentotal > (Payment Count * Single Amount). | |

| FREQUENCY | ✓ |

string | The frequency at which Periodic payments are charged. | W: Weekly,B: Bi-weekly,M: Monthly,H: Semi-monthly,Q: Quarterly,S: Semi-annual,Y: Yearly |

| PAYMENTS | ✓ |

int | Number of payments to process until the Periodic setup is expired. | 1/999 |

API Delete Periodic Sale

To delete a Periodic Sale within the gateway, submit DELETERECURRING in the <PWTRANSACTIONTYPE /> parameter along with the desired RECURRINGID.

Request Example:

<?xml version="1.0" encoding="UTF-8"?>

<PAYMENTREQUEST>

<TRANSACTIONHEADER>

<PWVERSION>3</PWVERSION>

<PWCLIENTID>{clientId}</PWCLIENTID>

<PWKEY>{key}</PWKEY>

<PWUSER>{username}</PWUSER>

<PWPASS>{password}</PWPASS>

<PWTRANSACTIONTYPE>DELETERECURRING</PWTRANSACTIONTYPE>

<XOPTION>TRUE</XOPTION>

<RECURRINGID>123</RECURRINGID>

</TRANSACTIONHEADER>

</PAYMENTREQUEST>

Request Parameters

| Parameter | Required | Type | Description | Validation |

|---|---|---|---|---|

| PWVERSION | ✓ |

int | The Paywire Gateway version number. | 3 |

| PWTRANSACTIONTYPE | ✓ |

string | Defines what transaction to process. | DELETERECURRING |

| XOPTION | ✓ |

Bool | Show the search result in XML or escaped XML. | TRUE or FALSE |

| RECURRINGID | ✓ |

int | Periodic Plan ID. |

Approved Response Example:

<?xml version="1.0" encoding="UTF-8"?>

<PAYMENTRESPONSE>

<RESULT>APPROVAL</RESULT>

<PWCLIENTID>{clientId}</PWCLIENTID>

<PAYMETH>C</PAYMETH>

<AMOUNT>0.00</AMOUNT>

<PWINVOICENUMBER>21141024825250035</PWINVOICENUMBER>

</PAYMENTRESPONSE>

Declined Response Example:

<?xml version="1.0" encoding="UTF-8"?>

<PAYMENTRESPONSE>

<RESULT>ERROR</RESULT>

<RESTEXT>INVALID RECURRINGID</RESTEXT>

</PAYMENTRESPONSE>

Response Parameters

| Parameter | Type | Description | Options |

|---|---|---|---|

| PWCLIENTID | string | Authentication credential provided to you by the administrator. | |

| PAYMETH | string | Method of payment that the transaction was processed with: E for web ACH, C for Card. |

|

| AMOUNT | decimal | The total amount of the transaction, including tax and any adjustments. | |

| PWINVOICENUMBER | string | The merchants unique invoice number associated with this transaction. |

API PreAuth

Request Example:

<?xml version="1.0" encoding="UTF-8"?>

<PAYMENTREQUEST>

<TRANSACTIONHEADER>

<PWVERSION>3</PWVERSION>

<PWCLIENTID>{clientId}</PWCLIENTID>

<PWKEY>{key}</PWKEY>

<PWUSER>{username}</PWUSER>

<PWPASS>{password}</PWPASS>

<PWTRANSACTIONTYPE>PREAUTH</PWTRANSACTIONTYPE>

<PWSALEAMOUNT>10</PWSALEAMOUNT>

<PWINVOICENUMBER>0987654321234567895</PWINVOICENUMBER>

</TRANSACTIONHEADER>

<CUSTOMER>

<PWMEDIA>CC</PWMEDIA>

<CARDNUMBER>4111111111111111</CARDNUMBER>

<EXP_MM>12</EXP_MM>

<EXP_YY>22</EXP_YY>

</CUSTOMER>

</PAYMENTREQUEST>

Response Example:

<?xml version="1.0" encoding="UTF-8"?>

<PAYMENTRESPONSE>

<RESULT>APPROVAL</RESULT>

<BATCHID>1</BATCHID>

<PWCLIENTID>0000000001</PWCLIENTID>

<AUTHCODE>092127</AUTHCODE>

<AVSCODE>R</AVSCODE>

<PAYMETH>C</PAYMETH>

<PWUNIQUEID>130909</PWUNIQUEID>

<AMOUNT>10.00</AMOUNT>

<MACCOUNT>XXXXXXXXXXXX1111</MACCOUNT>

<CCTYPE>VISA</CCTYPE>

<PWTOKEN>A39B7BD3NOK24CF12816</PWTOKEN>

<PWINVOICENUMBER>0987654321234567895</PWINVOICENUMBER>

</PAYMENTRESPONSE>

To process a Pre-Authorization transaction, submit PREAUTH in the <PWTRANSACTIONTYPE /> parameter. Mandatory fields are identical to the API One-Time-Sale.

API Void

Request Example:

<?xml version="1.0" encoding="UTF-8"?>

<PAYMENTREQUEST>

<TRANSACTIONHEADER>

<PWVERSION>3</PWVERSION>

<PWCLIENTID>{clientId}</PWCLIENTID>

<PWKEY>{key}</PWKEY>

<PWUSER>{username}</PWUSER>

<PWPASS>{password}</PWPASS>

<PWTRANSACTIONTYPE>VOID</PWTRANSACTIONTYPE>

<PWSALEAMOUNT>10</PWSALEAMOUNT>

<PWINVOICENUMBER>0987654321234567892</PWINVOICENUMBER>

<PWUNIQUEID>112301</PWUNIQUEID>

</TRANSACTIONHEADER>

</PAYMENTREQUEST>

Response Example:

<?xml version="1.0" encoding="UTF-8"?>

<PAYMENTRESPONSE>

<RESULT>APPROVAL</RESULT>

<BATCHID>162</BATCHID>

<PWCLIENTID>0000001403</PWCLIENTID>

<PAYMETH>A</PAYMETH>

<PWUNIQUEID>130903</PWUNIQUEID>

<AMOUNT>10.00</AMOUNT>

<MACCOUNT>XXXXXX4082</MACCOUNT>

<CCTYPE>ACH</CCTYPE>

<PWINVOICENUMBER>0987654321234567892</PWINVOICENUMBER>

</PAYMENTRESPONSE>

To process a Void transaction, submit VOID in the <PWTRANSACTIONTYPE /> parameter along with the mandatory fields.

| Parameter | Required | Type | Description | Validation |

|---|---|---|---|---|

| PWVERSION | ✓ |

int | The Paywire Gateway version number. | 3 |

| PWTRANSACTIONTYPE | ✓ |

string | Defines what transaction to process. | VOID |

| PWSALEAMOUNT | ✓ |

int/decimal | Amount of original transaction: Must match. | |

| PWINVOICENUMBER | string | The merchant's unique invoice number associated with this transaction. | ||

| PWUNIQUEID | ✓ |

int | Unique transaction ID returned in the transaction response, associated with the transaction being voided. |

API Credit

Request Example:

<?xml version="1.0" encoding="UTF-8"?>

<PAYMENTREQUEST>

<TRANSACTIONHEADER>

<PWVERSION>3</PWVERSION>

<PWCLIENTID>{clientId}</PWCLIENTID>

<PWKEY>{key}</PWKEY>

<PWUSER>{username}</PWUSER>

<PWPASS>{password}</PWPASS>

<PWTRANSACTIONTYPE>CREDIT</PWTRANSACTIONTYPE>

<PWSALEAMOUNT>10</PWSALEAMOUNT>

<PWINVOICENUMBER>0987654321234567893</PWINVOICENUMBER>

<PWUNIQUEID>130291</PWUNIQUEID>

</TRANSACTIONHEADER>

</PAYMENTREQUEST>

Response Example:

<?xml version="1.0" encoding="UTF-8"?>

<PAYMENTRESPONSE>

<RESULT>APPROVAL</RESULT>

<BATCHID>1</BATCHID>

<PWCLIENTID>0000000001</PWCLIENTID>

<PAYMETH>C</PAYMETH>

<PWUNIQUEID>112304</PWUNIQUEID>

<AHNAME>John Doe</AHNAME>

<AMOUNT>10.00</AMOUNT>

<MACCOUNT>XXXXXXXXXXXX1111</MACCOUNT>

<EMAIL>jd@example.com</EMAIL>

<CCTYPE>VISA</CCTYPE>

<PWINVOICENUMBER>0987654321234567893</PWINVOICENUMBER>

</PAYMENTRESPONSE>

To process a Credit transaction, submit CREDIT in the <PWTRANSACTIONTYPE /> parameter along with the mandatory fields.

| Parameter | Required | Type | Description | Validation |

|---|---|---|---|---|

| PWVERSION | ✓ |

int | The Paywire Gateway version number. | 3 |

| PWTRANSACTIONTYPE | ✓ |

string | Defines what transaction to process. | CREDIT |

| PWSALEAMOUNT | ✓ |

int/decimal | Amount to refund. | Less than or equal to the original transaction. |

| PWINVOICENUMBER | string | The merchant's unique invoice number associated with this transaction. | ||

| PWUNIQUEID | ✓ |

int | Unique transaction ID returned in the transaction response, associated with the transaction being voided. | |

| PWCUSTOMID1 | string | Custom third-party ID to be associated with this transaction. |

API Get Auth Token

Request Parameters

Request Example:

<?xml version="1.0" encoding="UTF-8"?>

<PAYMENTREQUEST>

<TRANSACTIONHEADER>

<PWVERSION>3</PWVERSION>

<PWCLIENTID>{clientId}</PWCLIENTID>

<PWKEY>{key}</PWKEY>

<PWUSER>{username}</PWUSER>

<PWPASS>{password}</PWPASS>

<PWTRANSACTIONTYPE>GETAUTHTOKEN</PWTRANSACTIONTYPE>

</TRANSACTIONHEADER>

</PAYMENTREQUEST>

| Parameter | Required | Type | Description | Validation |

|---|---|---|---|---|

| PWVERSION | ✓ |

int | The Paywire Gateway version number. | 3 |

| PWTRANSACTIONTYPE | ✓ |

string | Defines what transaction to process. | GETAUTHTOKEN |

Response Parameters

Response Example:

<?xml version="1.0" encoding="UTF-8"?>

<PAYMENTRESPONSE>

<RESULT>SUCCESS</RESULT>

<PWCLIENTID>{clientId}</PWCLIENTID>

<PWINVOICENUMBER>10070170834652361</PWINVOICENUMBER>

<AUTHTOKEN>4C2F8EE94CA2491AAB67EA6541CB17BA</AUTHTOKEN>

</PAYMENTRESPONSE>

| Parameter | Type | Description | Options |

|---|---|---|---|

| RESULT | string | Status for the request. | SUCCESS, ERROR |

| PWCLIENTID | string | Paywire-generated unique merchant identifier. | |

| PWINVOICENUMBER | string | Identifier for this request. | |

| AUTHTOKEN | string | The Authentication Token to be used when calling the OSBP. |

API Get Consumer Fee

Request Parameters

Request Example:

<?xml version="1.0" encoding="UTF-8"?>

<PAYMENTREQUEST>

<TRANSACTIONHEADER>

<PWVERSION>3</PWVERSION>

<PWCLIENTID>{clientId}</PWCLIENTID>

<PWKEY>{key}</PWKEY>

<PWUSER>{username}</PWUSER>

<PWPASS>{password}</PWPASS>

<PWTRANSACTIONTYPE>GETCONSUMERFEE</PWTRANSACTIONTYPE>

<PWSALEAMOUNT>10.00</PWSALEAMOUNT>

<PWINVOICENUMBER>0987654321234567896</PWINVOICENUMBER>

</TRANSACTIONHEADER>

<CUSTOMER>

<ADJTAXRATE>15.00</ADJTAXRATE>

<PWMEDIA>CC</PWMEDIA>

<STATE>NY</STATE>

</CUSTOMER>

</PAYMENTREQUEST>

For merchants configured with Cash Discount or Convenience Fees, submit GETCONSUMERFEE in the <PWTRANSACTIONTYPE /> parameter to retrieve the adjustment amount.

| Parameter | Required | Type | Description | Validation |

|---|---|---|---|---|

| PWVERSION | ✓ |

int | The Paywire Gateway version number. | 3 |

| PWTRANSACTIONTYPE | ✓ |

string | Defines what transaction to process. | GETCONSUMERFEE |

| PWSALEAMOUNT | ✓ |

int/decimal | Sale amount. | |

| PWINVOICENUMBER | string | The merchant's unique invoice number associated with this transaction. | ||

| PWMEDIA | ✓ |

string | Defines the payment method. | Fixed options: CC and ECHECK. |

| DISABLECF | bool | Overrides applying a Cash Discount or Convenience Fee when set to TRUE, if configured. Note that Sales Tax will also be disabled. |

Default: FALSE |

|

| ADJTAXRATE | decimal | Overrides the configured Sales Tax rate. | ||

| PWTOKEN | string | When submitted, returns customer or token details in the response. | ||

| STATE | (✓) |

string | Account Holder's state of residence. Required if configured with Convenience Fees. |

Response Parameters

Response Example:

<?xml version="1.0" encoding="UTF-8"?>

<PAYMENTRESPONSE>

<RESULT>APPROVAL</RESULT>

<PWCLIENTID>0000000001</PWCLIENTID>

<PAYMETH>C</PAYMETH>

<PWADJDESC>Convenience Fee</PWADJDESC>

<PWSALETAX>0.00</PWSALETAX>

<PWADJAMOUNT>5.00</PWADJAMOUNT>

<PWSALEAMOUNT>10.00</PWSALEAMOUNT>

<AMOUNT>15.00</AMOUNT>

<PWINVOICENUMBER>0987654321234567896</PWINVOICENUMBER>

<CDSUMMARY>

<MERCHANTNAME>Merchant ABC</MERCHANTNAME>

<MID>987345098456</MID>

<MERCHANTTYPE>F</MERCHANTTYPE>

<ADJTAXRATE>0.00</ADJTAXRATE>

<CARDSALESAMOUNT>10.00</CARDSALESAMOUNT>

<CARDADJAMOUNT>5.00</CARDADJAMOUNT>

<CARDTAXAMOUNT>0.00</CARDTAXAMOUNT>

<CARDTRANSACTIONAMOUNT>15.00</CARDTRANSACTIONAMOUNT>

<CARDAMOUNTBEFORETAX>15.00</CARDAMOUNTBEFORETAX>

<CASHSALESAMOUNT>10.00</CASHSALESAMOUNT>

<CASHADJAMOUNT>5.00</CASHADJAMOUNT>

<CASHTAXAMOUNT>0.00</CASHTAXAMOUNT>

<CASHTRANSACTIONAMOUNT>15.00</CASHTRANSACTIONAMOUNT>

<CASHAMOUNTBEFORETAX>15.00</CASHAMOUNTBEFORETAX>

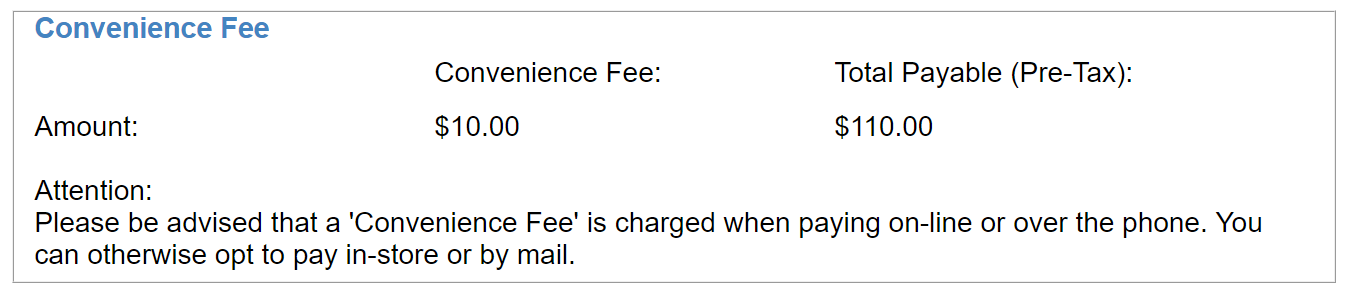

<CDDESCRIPTIONVPOS>Attention:

<br />Please advise the payee or customer that a 'Convenience Fee' will be charged when paying on-line or over the phone. They can otherwise opt to pay in-store or by mail.

</CDDESCRIPTIONVPOS>

<CDDESCRIPTIONOSBP>Attention:

<br />Please be advised that a 'Convenience Fee' is charged when paying on-line or over the phone. You can otherwise opt to pay in-store or by mail.

</CDDESCRIPTIONOSBP>

</CDSUMMARY>

</PAYMENTRESPONSE>

| Parameter | Type | Description | Options |

|---|---|---|---|

| RESULT | string | Status for the transaction. | APPROVAL, SUCCESS, DECLINED, ERROR |

| PWCLIENTID | string | Paywire-generated unique merchant identifier. | |

| PAYMETH | string | Describes the payment method. | C: Card, A: ACH |

| PWADJDESC | string | The description for the adjustment as set in the merchant configuration. | |

| PWSALETAX | decimal | The tax amount calculated by the gateway, based on the Sales Tax rate set in the merchant configuration. | |

| PWADJAMOUNT | decimal | The adjustment amount calculated by the gateway, based on the Adjustment rate or fixed amount set in the merchant configuration. This can be either the Cash Discount markdown or the Convenience Fee. | |

| PWSALEAMOUNT | decimal | The Sale amount submitted in the request. | |

| AMOUNT | decimal | The total amount of the transaction, including tax and any adjustments. | |

| PWINVOICENUMBER | string | The merchant's unique invoice number associated with this transaction. | |

| MERCHANTNAME | string | Name of the merchant as set in the merchant configuration. | |

| MID | string | The processor's merchant identifier. | |

| MERCHANTTYPE | string | The type of merchant as set in the merchant configuration. | A: General + Single SAP, B: Medical,C: General + Split SAP,D: Remote Check + SAP Invoices,E: Cash Discount,F: Convenience Fees |

| ADJTAXRATE | decimal | The Sales Tax rate as set in the merchant configuration or submitted in the request. | |

| CARDSALESAMOUNT | decimal | The Card Sale amount before tax and any adjustments. Relevant for Cash Discount. | |

| CARDADJAMOUNT | decimal | The Adjustment amount for a Card transaction. Relevant for Cash Discount. | |

| CARDTAXAMOUNT | decimal | The calculated Sales Tax amount for a Card transaction. Relevant for Cash Discount. | |

| CARDTRANSACTIONAMOUNT | decimal | The total amount for a Card transaction after tax and any adjustments. Relevant for Cash Discount. | |

| CARDAMOUNTBEFORETAX | decimal | The adjusted amount for a Card transaction before adding tax. Relevant for Cash Discount. | |

| CASHSALESAMOUNT | decimal | The Cash Sale amount before tax and any adjustments. Relevant for Cash Discount. | |

| CASHTAXAMOUNT | decimal | The calculated Sales Tax amount for a Cash transaction. Relevant for Cash Discount. | |

| CASHTRANSACTIONAMOUNT | decimal | The total amount for a Cash transaction after tax and any adjustments. Relevant for Cash Discount. | |

| CASHAMOUNTBEFORETAX | decimal | The adjusted amount for a Cash transaction before adding tax. Relevant for Cash Discount. | |

| CDDESCRIPTIONVPOS | string | The descriptive text set in the merchant configuration. To be displayed on the VPOS payment page. | |

| CDDESCRIPTIONOSBP | string | The descriptive text set in the merchant config. to be displayed on the OSBP payment page. | |

| AHNAME | string | ACH Account Holder full name. Returned only when ECHECK in PWMEDIA and a valid PWTOKEN are submitted in the request. |

|

| MACCOUNT | string | Masked Card or Account number. Returned only when a valid PWTOKEN is submitted in the request. |

|

| ROUTINGNUMBER | string | U.S. Bank Account routing number. Returned only when ECHECK in PWMEDIA and a valid PWTOKEN are submitted in the request. |

|

| BANKACCTTYPE | string | Type of Bank Account. Returned only when ECHECK in PWMEDIA and a valid PWTOKEN are submitted in the request. |

CHECKING, SAVINGS |

| EXP_MM | string | Card Expiry month. Returned only when CC in PWMEDIA and a valid PWTOKEN are submitted in the request. |

|

| EXP_YY | string | Card Expiry year. Returned only when CC in PWMEDIA and a valid PWTOKEN are submitted in the request. |

|

| FIRSTNAME | string | Account Holder first name. Returned only when a valid PWTOKEN is submitted in the request. |

|

| LASTNAME | string | Account Holder last name. Returned only when a valid PWTOKEN is submitted in the request. |

API Create Customer

Request Example

<?xml version="1.0" encoding="UTF-8"?>

<PAYMENTREQUEST>

<TRANSACTIONHEADER>

<PWVERSION>3</PWVERSION>

<PWCLIENTID>{clientId}</PWCLIENTID>

<PWKEY>{key}</PWKEY>

<PWUSER>{username}</PWUSER>

<PWPASS>{password}</PWPASS>

<PWTRANSACTIONTYPE>CREATECUSTOMER</PWTRANSACTIONTYPE>

</TRANSACTIONHEADER>

<DETAILRECORDS />

<CUSTOMER>

<COMPANYNAME>Company ABC</COMPANYNAME>

<FIRSTNAME>John</FIRSTNAME>

<LASTNAME>Doe</LASTNAME>

<EMAIL>jd@example.com</EMAIL>

<ADDRESS1>1, The Street</ADDRESS1>

<ADDRESS2>Unit 10</ADDRESS2>

<CITY>Los Angeles</CITY>

<STATE>CA</STATE>

<ZIP>12345</ZIP>

<COUNTRY>US</COUNTRY>

<PRIMARYPHONE>1234567890</PRIMARYPHONE>

<WORKPHONE>1234567890</WORKPHONE>

<DESCRIPTION>Description</DESCRIPTION>

<EXTCID>AA000123</EXTCID>

</CUSTOMER>

</PAYMENTREQUEST>

Response Example:

<?xml version="1.0" encoding="UTF-8"?>

<PAYMENTRESPONSE>

<RESULT>SUCCESS</RESULT>

<PWCLIENTID>0000000001</PWCLIENTID>

<PWCID>P0000000001</PWCID>

<PWINVOICENUMBER>0987654321234127820</PWINVOICENUMBER>

</PAYMENTRESPONSE>

To create a customer in the Paywire Vault, submit CREATECUSTOMER in the <PWTRANSACTIONTYPE /> parameter.

The gateway will return a customer identifier in <PWCID> if successful.

| Parameter | Required | Type | Description | Validation |

|---|---|---|---|---|

| PWVERSION | ✓ |

int | The Paywire Gateway version number. | 3 |

| PWTRANSACTIONTYPE | ✓ |

string | Defines what transaction to process. | CREATECUSTOMER |

| COMPANYNAME | string | Customer's company name. | ||

| ADDRESS1 | string | Customer's primary address. | ||

| ADDRESS2 | string | Customer's secondary address. | ||

| CITY | string | Customer's city of residence. | ||

| STATE | string | Customer's state of residence. | ||

| COUNTRY | string | Customer's country of residence. | ||

| ZIP | string | Customer's address postal/zip code, See important note on Zip Codes. | ||

| string | Customer's email address. | |||

| PRIMARYPHONE | string | Customer's primary phone number. | ||

| WORKPHONE | string | Customer's work phone number. | ||

| DESCRIPTION | string | Customer description. | 0/100 |

|

| EXTCID | string | External Customer ID | 0/50 |

API List Customer Tokens

Request Example

<PAYMENTREQUEST>

<TRANSACTIONHEADER>

<PWVERSION>3</PWVERSION>

<PWCLIENTID>{clientId}</PWCLIENTID>

<PWKEY>{key}</PWKEY>

<PWUSER>{username}</PWUSER>

<PWPASS>{password}</PWPASS>

<XOPTION>TRUE</XOPTION>

<PWTRANSACTIONTYPE>GETCUSTOKENS</PWTRANSACTIONTYPE>

</TRANSACTIONHEADER>

<DETAILRECORDS />

<CUSTOMER>

<PWCID>P0000000001</PWCID>

<EXTCID>AA000123</EXTCID>

</CUSTOMER>

</PAYMENTREQUEST>

Response Example:

<?xml version="1.0" encoding="UTF-8"?>

<PAYMENTRESPONSE>

<RESULT>SUCCESS</RESULT>

<PWCLIENTID>0000000120</PWCLIENTID>

<PWCUSTOMERDETAILS>

<PWCUSTOMERDETAIL>

<PWCID>P00008F4039</PWCID>

<EXTCID>test</EXTCID>

<CUSTOMERNAME>Test Last</CUSTOMERNAME>

<EMAIL>test@example.com</EMAIL>

<PHONE>8888888888</PHONE>

<ADDRESS>1 Main St</ADDRESS>

<CITY>Hartford</CITY>

<STATE>AE</STATE>

<ZIP>06105</ZIP>

<TOKENS>

<PWTOKENDETAIL>

<PWTOKEN>TB32D49C0B9CA840</PWTOKEN>

<PWMEDIA>CC</PWMEDIA>

<CCTYPE>MC</CCTYPE>

<MACCOUNT>X608 </MACCOUNT>

<EXP_MM>02</EXP_MM>

<EXP_YY>25</EXP_YY>

</PWTOKENDETAIL>

<PWTOKENDETAIL>

<PWTOKEN>T3C6A1FC9B022912</PWTOKEN>

<PWMEDIA>CC</PWMEDIA>

<CCTYPE>VISA</CCTYPE>

<MACCOUNT>XXXXXXXXXXXX1111</MACCOUNT>

<EXP_MM>12</EXP_MM>

<EXP_YY>22</EXP_YY>

</PWTOKENDETAIL>

<PWTOKENDETAIL>

<PWTOKEN>T19EE239FE11C914</PWTOKEN>

<PWMEDIA>CC</PWMEDIA>

<CCTYPE>VISA</CCTYPE>

<MACCOUNT>XXXXXXXXXXXX1111</MACCOUNT>

<EXP_MM>02</EXP_MM>

<EXP_YY>20</EXP_YY>

</PWTOKENDETAIL>

</TOKENS>

</PWCUSTOMERDETAIL>

<PWCUSTOMERDETAIL>

<PWCID>P00008F8043</PWCID>

<EXTCID>test</EXTCID>

<CUSTOMERNAME>tttt</CUSTOMERNAME>

</PWCUSTOMERDETAIL>

</PWCUSTOMERDETAILS>

</PAYMENTRESPONSE>

To list tokens stored against a customer in the Paywire Vault, submit GETCUSTOKENS in the <PWTRANSACTIONTYPE /> parameter, along with parameters <PWCID> or <EXTCID>. If more than one condition is passed, the logic will consider only one condition and the precedence order is PWCID>EXTCID.

Request Parameters:

| Parameter | Required | Type | Description | Validation |

|---|---|---|---|---|

| PWVERSION | ✓ |

int | The Paywire Gateway version number. | 3 |

| PWTRANSACTIONTYPE | ✓ |

string | Defines what transaction to process. | GETCUSTOKENS |

| XOPTION | Bool | Show the search result in XML or escaped XML. | Options: TRUE or FALSE |

|

| PWCID | string | Identifier for Customer stored in the Paywire Vault. | ||

| EXTCID | string | External Customer ID. |

Response Parameters:

| Parameter | Type | Description | Options |

|---|---|---|---|

| PWCID | string | Identifier for Customer stored in the Paywire Vault. | |

| EXTCID | string | External Customer ID. | |

| CUSTOMERNAME | string | Customer's Name. | |

| COMPANY | string | Customer's Company Name. | |

| string | Customer's email address. | ||

| PHONE | string | Customer's Phone. | |

| ADDRESS | string | Customer's primary address. | |

| ADDRESS2 | string | Customer's secondary address. | |

| CITY | string | Customer's city of residence. | |

| STATE | string | Customer's state or province of residence. | |

| ZIP | string | Customer's address postal/zip code, See important note on Zip Codes. | |

| NOTES | string | Customer's additional information. | |

| PWTOKEN | string | Unique token representing a customer's card or account details stored on the Paywire Gateway. | |

| PWMEDIA | string | Defines the payment method. | CCECHECK |

| BANKACCTTYPE | string | Type of Bank Account. Returned only when ECHECK in PWMEDIA and a valid PWTOKEN are submitted in the request. |

CHECKING,SAVINGS |

| CCTYPE | string | Type of Credit Card. Returned only when CC in PWMEDIA. |

VISA,MC,DISC,AMEX,CUP,JCB,DINERS |

| MACCOUNT | string | Masked account number. | |

| EXP_MM | string | Card expiry month. Returned only when CC in PWMEDIA. |

|

| EXP_YY | string | Card expiry year. Returned only when CC in PWMEDIA. |

API Store Token

Request Example for Credit Card:

<?xml version="1.0" encoding="UTF-8"?>

<PAYMENTREQUEST>

<TRANSACTIONHEADER>

<PWVERSION>3</PWVERSION>

<PWCLIENTID>{clientId}</PWCLIENTID>

<PWKEY>{key}</PWKEY>

<PWUSER>{username}</PWUSER>

<PWPASS>{password}</PWPASS>

<PWTRANSACTIONTYPE>STORETOKEN</PWTRANSACTIONTYPE>

<PWSALEAMOUNT>10</PWSALEAMOUNT>

<PWINVOICENUMBER>0987654321234567897</PWINVOICENUMBER>

</TRANSACTIONHEADER>

<CUSTOMER>

<COMPANYNAME>The Company</COMPANYNAME>

<FIRSTNAME>John</FIRSTNAME>

<LASTNAME>Doe</LASTNAME>

<EMAIL>jd@example.com</EMAIL>

<ADDRESS1>1 The Street</ADDRESS1>

<CITY>New York</CITY>

<STATE>NY</STATE>

<ZIP>12345</ZIP>

<COUNTRY>US</COUNTRY>

<PRIMARYPHONE>1234567890</PRIMARYPHONE>

<WORKPHONE>1234567890</WORKPHONE>

<PWMEDIA>CC</PWMEDIA>

<CARDNUMBER>4111111111111111</CARDNUMBER>

<EXP_MM>02</EXP_MM>

<EXP_YY>22</EXP_YY>

<CVV2>123</CVV2>

</CUSTOMER>

</PAYMENTREQUEST>

Response Example for Credit Card:

<?xml version="1.0" encoding="UTF-8"?>

<PAYMENTRESPONSE>

<RESULT>APPROVAL</RESULT>

<BATCHID>1</BATCHID>

<PWCLIENTID>0000000001</PWCLIENTID>

<AVSCODE>0</AVSCODE>

<PAYMETH>C</PAYMETH>

<PWUNIQUEID>130310</PWUNIQUEID>

<AMOUNT>0.00</AMOUNT>

<MACCOUNT>XXXXXXXXXXXX1111</MACCOUNT>

<CCTYPE>VISA</CCTYPE>

<PWTOKEN>56A6603A4141234A2817</PWTOKEN>

<PWINVOICENUMBER>0987654321234567897</PWINVOICENUMBER>

</PAYMENTRESPONSE>

Request Example for ECheck:

<?xml version="1.0" encoding="UTF-8"?>

<PAYMENTREQUEST>

<TRANSACTIONHEADER>

<PWVERSION>3</PWVERSION>

<PWCLIENTID>{clientId}</PWCLIENTID>

<PWKEY>{key}</PWKEY>

<PWUSER>{username}</PWUSER>

<PWPASS>{password}</PWPASS>

<PWTRANSACTIONTYPE>STORETOKEN</PWTRANSACTIONTYPE>

<PWSALEAMOUNT>10</PWSALEAMOUNT>

<PWINVOICENUMBER>0987654321234567897</PWINVOICENUMBER>

</TRANSACTIONHEADER>

<CUSTOMER>

<COMPANYNAME>The Company</COMPANYNAME>

<FIRSTNAME>John</FIRSTNAME>

<LASTNAME>Doe</LASTNAME>

<EMAIL>jd@example.com</EMAIL>

<ADDRESS1>1 The Street</ADDRESS1>

<CITY>New York</CITY>

<STATE>NY</STATE>

<ZIP>12345</ZIP>

<COUNTRY>US</COUNTRY>

<PRIMARYPHONE>1234567890</PRIMARYPHONE>

<WORKPHONE>1234567890</WORKPHONE>

<PWMEDIA>ECHECK</PWMEDIA>

<ROUTINGNUMBER>222224444</ROUTINGNUMBER>

<ACCOUNTNUMBER>123456</ACCOUNTNUMBER>

<BANKACCTTYPE>CHECKING</BANKACCTTYPE>

</CUSTOMER>

</PAYMENTREQUEST>

Response Example for ECheck:

<?xml version="1.0" encoding="UTF-8"?>

<PAYMENTRESPONSE>

<RESULT>APPROVAL</RESULT>

<BATCHID>1</BATCHID>

<PWCLIENTID>0000000001</PWCLIENTID>

<PAYMETH>A</PAYMETH>

<PWUNIQUEID>130310</PWUNIQUEID>

<AHNAME>John Doe</AHNAME>

<PWSALETAX>0.00</PWSALETAX>

<PWADJAMOUNT>0.00</PWADJAMOUNT>

<PWSALEAMOUNT>10.00</PWSALEAMOUNT>

<AMOUNT>0.00</AMOUNT>

<MACCOUNT>XXXXXX4082</MACCOUNT>

<CCTYPE>ACH</CCTYPE>

<PWCUSTOMERID>T31F547196597457</PWCUSTOMERID>

<PWTOKEN>56A6603A4141234A2817</PWTOKEN>

<PWCID>P0000007990</PWCID>

<PWINVOICENUMBER>0987654321234567897</PWINVOICENUMBER>

</PAYMENTRESPONSE>

In order to store a customer's payment details (card or e-check), submit STORETOKEN in the <PWTRANSACTIONTYPE /> parameter.

The gateway will return a token in <PWTOKEN> if successful.

| Parameter | Required | Type | Description | Validation |

|---|---|---|---|---|

| PWVERSION | ✓ |

int | The Paywire Gateway version number. | 3 |

| PWTRANSACTIONTYPE | ✓ |

string | Defines what transaction to process. | STORETOKEN |

| PWSALEAMOUNT | ✓ |

int/decimal | Set to 0, otherwise a SALE is processed. |

|

| PWINVOICENUMBER | string | The merchants unique invoice number associated with this transaction. | ||

| COMPANYNAME | string | Customer's company name. | ||

| PWMEDIA | ✓ |

string | Defines the payment method. | Fixed options: CC and ECHECK. |

| CARDNUMBER | ✓ |

int | Card number to be stored. Required only when CC is submitted in PWMEDIA. |

|

| EXP_MM | ✓ |

string | Card expiry month. Required only when CC is submitted in PWMEDIA. |

2/2, >0, <=12 |

| EXP_YY | ✓ |

string | Card expiry year. Required only when CC is submitted in PWMEDIA. |

2/2 |

| CVV2 | int | Card Verification Value. Required only when CC is submitted in PWMEDIA, available for Union Pay merchants. |

3/4 |

|

| ROUTINGNUMBER | (✓) |

string | Routing number of Bank Account being stored. Required only when ECHECK is submitted in PWMEDIA. |

|

| ACCOUNTNUMBER | (✓) |

string | Account number of Bank Account being stored. Required only when ECHECK is submitted in PWMEDIA. |

|

| BANKACCTTYPE | (✓) |

string | Type of Bank Account to process payment with. Required only when ECHECK is submitted in PWMEDIA. |

CHECKING, SAVINGS |

| ADDCUSTOMER | bool | Creates a customer in the Paywire Vault associated with the token, and returns a PWCID in the response when set to TRUE. |

||

| PWCID | string | Paywire Customer Identifier. When submitted, the created token will be associated with this customer. | ||

| FIRSTNAME | string | Account Holder's first name. | ||

| LASTNAME | string | Account Holder's last name. | ||

| string | Account Holder's email address. | |||

| ADDRESS1 | string | Account Holder's primary address. | ||

| ADDRESS2 | string | Account Holder's secondary address. | ||

| CITY | string | Account Holder's city of residence. | ||

| STATE | string | Account Holder's state of residence. Required if configured with Convenience Fees. | ||

| COUNTRY | string | Account Holder's country of residence. | ||

| ZIP | string | Account Holder's address postal/zip code. See important note on Zip Codes. | ||

| PRIMARYPHONE | string | Account Holder's primary phone number. | ||

| WORKPHONE | string | Account Holder's work phone number. |

API Token Sale

Request Example:

<?xml version="1.0" encoding="UTF-8"?>

<PAYMENTREQUEST>

<TRANSACTIONHEADER>

<PWVERSION>3</PWVERSION>

<PWCLIENTID>{clientId}</PWCLIENTID>

<PWKEY>{key}</PWKEY>

<PWUSER>{username}</PWUSER>

<PWPASS>{password}</PWPASS>

<PWTRANSACTIONTYPE>SALE</PWTRANSACTIONTYPE>

<PWSALEAMOUNT>20.00</PWSALEAMOUNT>

<PWINVOICENUMBER>0987654321234567898</PWINVOICENUMBER>

<POSINDICATOR>P</POSINDICATOR>

<PWADJAMOUNT>1.00</PWADJAMOUNT>

</TRANSACTIONHEADER>

<CUSTOMER>

<PWMEDIA>CC</PWMEDIA>

<PWTOKEN>T6767AB4C79CA132</PWTOKEN>

<STATE>NY</STATE>

</CUSTOMER>

</PAYMENTREQUEST>

Response Example:

<?xml version="1.0" encoding="UTF-8"?>

<PAYMENTRESPONSE>

<RESULT>APPROVAL</RESULT>

<BATCHID>1</BATCHID>

<PWCLIENTID>0000000001</PWCLIENTID>

<AUTHCODE>081257</AUTHCODE>

<AVSCODE>N</AVSCODE>

<PAYMETH>C</PAYMETH>

<PWUNIQUEID>120115</PWUNIQUEID>

<AHNAME>John Doe</AHNAME>

<PWSALETAX>0.00</PWSALETAX>

<PWADJAMOUNT>1.00</PWADJAMOUNT>

<PWSALEAMOUNT>20.00</PWSALEAMOUNT>

<AMOUNT>21.00</AMOUNT>

<MACCOUNT>XXXXXXXXXXXX0608</MACCOUNT>

<EMAIL>test@example.com</EMAIL>

<CCTYPE>MC</CCTYPE>

<PWCUSTOMERID>T6767AB4C79CA132</PWCUSTOMERID>

<PWTOKEN>T6767AB4C79CA132</PWTOKEN>

<PWCUSTOMID1>23232121321</PWCUSTOMID1>

<PWCUSTOMID2>f188b4a50a7c3352951a5ba09cc092a6</PWCUSTOMID2>

<PWINVOICENUMBER>0987654321234567898</PWINVOICENUMBER>

</PAYMENTRESPONSE>

To process a SALE using a token, simply replace the Card or E-Check payment details with the <PWTOKEN> parameter returned by the gateway when storing tokens.

The same fields as the API One-Time-Sale apply: It must be noted that this customer information can be sent as well to overwrite what has been stored.

| Parameter | Required | Type | Description | Validation |

|---|---|---|---|---|

| PWTOKEN | ✓ |

string | Token returned by the Paywire Gateway. | |

| PWMEDIA | ✓ |

string | Defines the payment method. | Fixed options: CC and ECHECK. |

| DISABLECF | Bool | Overrides applying a Convenience Fee or Cash Discount when set to TRUE, if configured. Note that Sales Tax will also be disabled. Default: FALSE. |

TRUEFALSE |

|

| POSINDICATOR | string | Used in conjunction with Token Sales to apply Convenience Fees or Cash Discount for periodic payments handled outside Paywire. Submit this in the TRANSACTIONHEADER block. |

C: Regular Token Sale I: First Payment of a Periodic Plan R: Subsequent Periodic Payment T: Last Payment of a Periodic Plan P: Periodic Payment |

|

| PWADJAMOUNT | decimal | Adjustment amount. Used to set the Convenience Fee amount to be charged for this transaction. Allowed only when submitted with POSINDICATOR set to P. Submitting amounts larger than that configured for the merchant will be ignored. |

>0 |

|

| STATE | (✓) |

string | Account Holder's state of residence. Required if configured with Convenience Fees. |

API Remove Token

Request Example:

<?xml version="1.0" encoding="UTF-8"?>

<PAYMENTREQUEST>

<TRANSACTIONHEADER>

<PWVERSION>3</PWVERSION>

<PWCLIENTID>{clientId}</PWCLIENTID>

<PWKEY>{key}</PWKEY>

<PWUSER>{username}</PWUSER>

<PWPASS>{password}</PWPASS>

<PWTRANSACTIONTYPE>REMOVETOKEN</PWTRANSACTIONTYPE>

<PWSALEAMOUNT>10</PWSALEAMOUNT>

<PWINVOICENUMBER>0987654321234567899</PWINVOICENUMBER>

</TRANSACTIONHEADER>

<CUSTOMER>

<PWCTRANSTYPE>3</PWCTRANSTYPE>

<PWMEDIA>CC</PWMEDIA>

<PWTOKEN>56A6603A41444122817</PWTOKEN>

</CUSTOMER>

</PAYMENTREQUEST>

Response Example:

<?xml version="1.0" encoding="UTF-8"?>

<PAYMENTRESPONSE>

<RESULT>APPROVAL</RESULT>

<PWCLIENTID>0000000001</PWCLIENTID>

<PAYMETH>C</PAYMETH>

<AMOUNT>0.00</AMOUNT>

<PWINVOICENUMBER>0987654321234567899</PWINVOICENUMBER>

</PAYMENTRESPONSE>

To remove a token, submit REMOVETOKEN in the <PWTRANSACTIONTYPE /> parameter along with the token to delete in <PWTOKEN />.

| Parameter | Required | Type | Description | Validation |

|---|---|---|---|---|

| PWVERSION | ✓ |

int | The Paywire Gateway version number. | 3 |

| PWTRANSACTIONTYPE | ✓ |

string | Defines what transaction to process. | REMOVETOKEN |

| PWTOKEN | ✓ |

string | Token returned by the Paywire Gateway. |

API Verification

Request Example:

<?xml version="1.0" encoding="UTF-8"?>

<PAYMENTREQUEST>

<TRANSACTIONHEADER>

<PWVERSION>3</PWVERSION>

<PWCLIENTID>{clientId}</PWCLIENTID>

<PWKEY>{key}</PWKEY>

<PWUSER>{username}</PWUSER>

<PWPASS>{password}</PWPASS>

<PWTRANSACTIONTYPE>VERIFICATION</PWTRANSACTIONTYPE>

<PWSALEAMOUNT>0.00</PWSALEAMOUNT>

</TRANSACTIONHEADER>

<DETAILRECORDS />

<CUSTOMER>

<REQUESTTOKEN>FALSE</REQUESTTOKEN>

<PWMEDIA>CC</PWMEDIA>

<FIRSTNAME>John</FIRSTNAME>

<LASTNAME>Doe</LASTNAME>

<EMAIL>johndoe@email.com</EMAIL>

<PRIMARYPHONE>7035551212</PRIMARYPHONE>

<CARDNUMBER>4111111111111111</CARDNUMBER>

<EXP_MM>12</EXP_MM>

<EXP_YY>33</EXP_YY>

<CVV2>123</CVV2>

<ADDRESS1>1 The Street</ADDRESS1>

<ZIP>12345</ZIP>

</CUSTOMER>

</PAYMENTREQUEST>

Response Example:

<?xml version="1.0" encoding="UTF-8"?>

<PAYMENTRESPONSE>

<RESULT>APPROVAL</RESULT>

<BATCHID>167792</BATCHID>

<PWCLIENTID>0000000519</PWCLIENTID>

<AUTHCODE>09636C</AUTHCODE>

<AVSCODE>Z</AVSCODE>

<CVVCODE>M</CVVCODE>

<PAYMETH>C</PAYMETH>

<PWUNIQUEID>4771740</PWUNIQUEID>

<AMOUNT>0.00</AMOUNT>

<MACCOUNT>XXXXXXXXXXXX8628</MACCOUNT>

<CCTYPE>VISA</CCTYPE>

<PWCUSTOMID2>b6d469d28fd33cf5acb627bcf6ca0496</PWCUSTOMID2>

</PAYMENTRESPONSE>

A verification transaction will verify the customer's card or bank account before submitting the payment.

Request Parameters

| Parameter | Required | Type | Description | Validation |

|---|---|---|---|---|

| PWVERSION | ✓ |

int | The Paywire Gateway version number. | 3 |

| PWTRANSACTIONTYPE | ✓ |

string | Defines what transaction to process. | SALE |

| PWSALEAMOUNT | ✓ |

int/decimal | Amount of the transaction. | |

| PWMEDIA | ✓ |

string | Defines the payment method. | Fixed options: CC and ECHECK. |

| CARDNUMBER | ✓ |

int | Card number with which to process the payment. Required only when CC is submitted in PWMEDIA. |

|

| EXP_MM | ✓ |

string | Card expiry month. Required only when CC is submitted in PWMEDIA. |

2/2, >0, <=12 |

| EXP_YY | ✓ |

string | Card expiry year. Required only when CC is submitted in PWMEDIA. |

2/2 |

| CVV2 | ✓ |

int | Card Verification Value. Required only when CC is submitted in PWMEDIA. |

3/4 |

| CUSTOMERNAME | string | Full name of the customer, possibly different than the Account Holder. | ||

| FIRSTNAME | string | Account Holder's first name. | ||

| LASTNAME | string | Account Holder's last name. | ||

| ADDRESS1 | string | Account Holder's primary address. | ||

| ZIP | string | Account Holder's address postal/zip code. See important note on Zip Codes. | ||

| string | Account Holder's email address. | |||

| PRIMARYPHONE | string | Account Holder's primary phone number. |

Response Parameters

| Parameter | Type | Description | Options |

|---|---|---|---|

| RESULT | string | UnionPay transaction result. | |

| BATCHID | int | Batch number. | |

| PWCLIENTID | string | Paywire client ID. | |

| AUTHCODE | string | Authorization code associated with the transaction. | |

| AVSCODE | string | Transaction AVS code result. Refer to the AVS Codes table | |

| CVVCODE | string | CVV response code. | |

| PAYMETH | string | Payment method. | |

| PWUNIQUEID | int | The Paywire Unique ID returned in the Initialize response. | 3 |

| AMOUNT | decimal | Payment amount. | |

| MACCOUNT | string | Masked credit card number. | |

| CCTYPE | string | Credit card type. | |

| PWCUSTOMID2 | string | Client custom ID. |

API Split Transaction

Request Example:

<?xml version="1.0" encoding="UTF-8"?>

<PAYMENTREQUEST>

<TRANSACTIONHEADER>

<PWVERSION>3</PWVERSION>

<PWCLIENTID>{clientId}</PWCLIENTID>

<PWKEY>{key}</PWKEY>

<PWUSER>{username}</PWUSER>

<PWPASS>{password}</PWPASS>

<PWTRANSACTIONTYPE>SALE</PWTRANSACTIONTYPE>

<PWSALEAMOUNT>100.00</PWSALEAMOUNT>

<PWINVOICENUMBER>1234567890</PWINVOICENUMBER>

</TRANSACTIONHEADER>

<CUSTOMER>

<COMPANYNAME>The Company</COMPANYNAME>

<FIRSTNAME>John</FIRSTNAME>

<LASTNAME>Doe</LASTNAME>

<EMAIL>jd@example.com</EMAIL>

<ADDRESS1>1 The Street</ADDRESS1>

<CITY>New York</CITY>

<STATE>NY</STATE>

<ZIP>12345</ZIP>

<COUNTRY>US</COUNTRY>

<PRIMARYPHONE>1234567890</PRIMARYPHONE>

<WORKPHONE>1234567890</WORKPHONE>

<PWMEDIA>CC</PWMEDIA>

<CARDNUMBER>4111111111111111</CARDNUMBER>

<EXP_MM>02</EXP_MM>

<EXP_YY>22</EXP_YY>

<CVV2>123</CVV2>

</CUSTOMER>

<SPLITDETAILS>

<SPLITITEM>

<PWSPLITID>12340001</PWSPLITID>

<SPLITAMOUNT>10.00</SPLITAMOUNT>

</SPLITITEM>

<SPLITITEM>

<PWSPLITID>12340002</PWSPLITID>

<SPLITAMOUNT>20.00</SPLITAMOUNT>

</SPLITITEM>

<SPLITITEM>

<PWSPLITID>12340003</PWSPLITID>

<SPLITAMOUNT>70.00</SPLITAMOUNT>

</SPLITITEM>

</SPLITDETAILS>

</PAYMENTREQUEST>

Response Example:

<?xml version="1.0" encoding="UTF-8"?>

<PAYMENTRESPONSE>

<RESULT>APPROVAL</RESULT>

<BATCHID>167792</BATCHID>

<PWCLIENTID>{clientId}</PWCLIENTID>

<AUTHCODE>09636C</AUTHCODE>

<AVSCODE>Z</AVSCODE>

<CVVCODE>M</CVVCODE>

<PAYMETH>C</PAYMETH>

<PWUNIQUEID>4567890</PWUNIQUEID>

<AMOUNT>100.00</AMOUNT>

<MACCOUNT>XXXXXXXXXXXX1111</MACCOUNT>

<CCTYPE>VISA</CCTYPE>

<PWINVOICENUMBER>1234567890</PWINVOICENUMBER>

</PAYMENTRESPONSE>

Split transaction processing is only valid for qualified merchants.

To process a SALE or CREDIT with split transactions: Append the <SPLITDETAILS> node in addition to the transaction request.

The <SPLITDETAILS> node may contain one or more <SPLITITEM> nodes. Each <SPLITITEM> contains the Split ID and the Split Amount.

The split amount total cannot exceed the original transaction amount. If the split amount total is less than the original transaction amount, the rest of the amount will deposit to the main MID that processed the authorization.

Request Parameters

| Parameter | Required | Type | Description | Validation |

|---|---|---|---|---|

| SPLITDETAILS | node | Include this node to process split transactions. Should contain one or more <SPLITITEM> nodes. |

Only one group of <SPLITDETAILS> is allowed. |

|

| SPLITITEM | node | Child node of the <SPLITDETAILS> node. |

Must contain <PWSPLITID> and <SPLITAMOUNT>. |

|

| PWSPLITID | ✓ |

string | Parameter of <SPLITITEM>. The split ID of the ghost MID. |

Must be a valid split ID that is associated with the current merchant. |

| SPLITAMOUNT | ✓ |

decimal | Parameter of <SPLITITEM>. The split amount for the corresponding ghost MID. |

Split amount total should be less than or equal to the original transaction amount. |

API UnionPay

Initialize Credit Card Transaction Request Example:

<?xml version="1.0" encoding="UTF-8"?>

<PAYMENTREQUEST>

<TRANSACTIONHEADER>

<PWVERSION>3</PWVERSION>

<PWCLIENTID>{clientId}</PWCLIENTID>

<PWKEY>{key}</PWKEY>

<PWUSER>{username}</PWUSER>

<PWPASS>{password}</PWPASS>

<PWTRANSACTIONTYPE>INITIALIZE</PWTRANSACTIONTYPE>

<PWSALEAMOUNT>10.00</PWSALEAMOUNT>

<CURRENCY>USD</CURRENCY>

<PWINVOICENUMBER>testcup200504001</PWINVOICENUMBER>

<REQUESTTOKEN>FALSE</REQUESTTOKEN>

</TRANSACTIONHEADER>

<CUSTOMER>

<PWMEDIA>CC</PWMEDIA>

<CARDNUMBER>6222821234560017</CARDNUMBER>

<EXP_MM>12</EXP_MM>

<EXP_YY>33</EXP_YY>

<PRIMARYPHONE>86-13012345678</PRIMARYPHONE>

<FIRSTNAME>Sample</FIRSTNAME>

<LASTNAME>Name</LASTNAME>

</CUSTOMER>

</PAYMENTREQUEST>

Initialize Credit Card Transaction Response Example:

<?xml version="1.0" encoding="UTF-8"?>

<PAYMENTRESPONSE>

<RESULT>APPROVAL</RESULT>

<BATCHID>641</BATCHID>

<PWCLIENTID>{clientId}</PWCLIENTID>

<PAYMETH>C</PAYMETH>

<PWUNIQUEID>2314876</PWUNIQUEID>

<AHNAME>Sample Name</AHNAME>

<AMOUNT>10.00</AMOUNT>

<MACCOUNT>XXXXXXXXXXXX0017</MACCOUNT>

<CCTYPE>CUP</CCTYPE>

<PWCUSTOMID2>000000189897</PWCUSTOMID2>

<PWINVOICENUMBER>testcup200504001</PWINVOICENUMBER>

<ISDEBIT>FALSE</ISDEBIT>

<CURRENCY>USD</CURRENCY>

</PAYMENTRESPONSE>

Finalize Credit Card Transaction Request Example:

<?xml version="1.0" encoding="UTF-8"?>

<PAYMENTREQUEST>

<TRANSACTIONHEADER>

<PWVERSION>3</PWVERSION>

<PWCLIENTID>{clientId}</PWCLIENTID>

<PWKEY>{key}</PWKEY>

<PWUSER>{username}</PWUSER>

<PWPASS>{password}</PWPASS>

<PWTRANSACTIONTYPE>FINALIZE</PWTRANSACTIONTYPE>

<PWINVOICENUMBER>test_002</PWINVOICENUMBER>

</TRANSACTIONHEADER>

<CUSTOMER>

<PWUNIQUEID>189897</PWUNIQUEID>

<SECURECODE>111111</SECURECODE>

<CVV2>123</CVV2>

</CUSTOMER>

</PAYMENTREQUEST>

Finalize Credit Card Transaction Response Example:

<?xml version="1.0" encoding="UTF-8"?>

<PAYMENTRESPONSE>

<RESULT>APPROVAL</RESULT>

<BATCHID>641</BATCHID>

<PWCLIENTID>{clientId}</PWCLIENTID>

<AUTHCODE>123456</AUTHCODE>

<CVVCODE> </CVVCODE>

<PAYMETH>C</PAYMETH>

<PWUNIQUEID>189897</PWUNIQUEID>

<AMOUNT>10.00</AMOUNT>

<MACCOUNT>XXXXXXXXXXXX0017</MACCOUNT>

<CCTYPE>CUP</CCTYPE>

<PWTOKEN>XXXXXXXXXXXXXXXXXXXX</PWTOKEN>

<PWCUSTOMID2>00000023123456</PWCUSTOMID2>

<PWINVOICENUMBER>test_002</PWINVOICENUMBER>

<CURRENCY>USD</CURRENCY>

</PAYMENTRESPONSE>

Initialize Debit Card Transaction Request Example:

<?xml version="1.0" encoding="UTF-8"?>

<PAYMENTREQUEST>

<TRANSACTIONHEADER>

<PWVERSION>3</PWVERSION>

<PWCLIENTID>{clientId}</PWCLIENTID>

<PWKEY>{key}</PWKEY>

<PWUSER>{username}</PWUSER>

<PWPASS>{password}</PWPASS>

<PWTRANSACTIONTYPE>INITIALIZE</PWTRANSACTIONTYPE>

<PWSALEAMOUNT>10.00</PWSALEAMOUNT>

<CURRENCY>USD</CURRENCY>

<PWINVOICENUMBER>testcup200504005</PWINVOICENUMBER>

<REQUESTTOKEN>FALSE</REQUESTTOKEN>

</TRANSACTIONHEADER>

<CUSTOMER>

<PWMEDIA>CC</PWMEDIA>

<CARDNUMBER>6250946000000016</CARDNUMBER>

<EXP_MM>12</EXP_MM>

<EXP_YY>33</EXP_YY>

<PRIMARYPHONE>852-11112222</PRIMARYPHONE>

<FIRSTNAME>Sample</FIRSTNAME>

<LASTNAME>Name</LASTNAME>

</CUSTOMER>

</PAYMENTREQUEST>

Initialize Debit Card Transaction Response Example:

<?xml version="1.0" encoding="UTF-8"?>

<PAYMENTRESPONSE>

<RESULT>APPROVAL</RESULT>

<BATCHID>641</BATCHID>

<PWCLIENTID>{clientId}</PWCLIENTID>

<PAYMETH>C</PAYMETH>

<PWUNIQUEID>189899</PWUNIQUEID>

<AHNAME>Sample Name</AHNAME>

<AMOUNT>10.00</AMOUNT>

<MACCOUNT>XXXXXXXXXXXX0016</MACCOUNT>

<CCTYPE>CUP</CCTYPE>

<PWCUSTOMID2>000000223154</PWCUSTOMID2>

<PWINVOICENUMBER>testcup200504005</PWINVOICENUMBER>

<ISDEBIT>TRUE</ISDEBIT>

<CURRENCY>USD</CURRENCY>

</PAYMENTRESPONSE>

Finalize Debit Card Request Transaction Example:

<?xml version="1.0" encoding="UTF-8"?>

<PAYMENTREQUEST>

<TRANSACTIONHEADER>

<PWVERSION>3</PWVERSION>

<PWCLIENTID>{clientId}</PWCLIENTID>

<PWKEY>{key}</PWKEY>

<PWUSER>{username}</PWUSER>

<PWPASS>{password}</PWPASS>

<PWTRANSACTIONTYPE>FINALIZE</PWTRANSACTIONTYPE>

</TRANSACTIONHEADER>

<CUSTOMER>

<PWUNIQUEID>189899</PWUNIQUEID>

<SECURECODE>111111</SECURECODE>

</CUSTOMER>

</PAYMENTREQUEST>

Finalize Debit Card Transaction Response Example:

<?xml version="1.0" encoding="UTF-8"?>

<PAYMENTRESPONSE>

<RESULT>APPROVAL</RESULT>

<BATCHID>641</BATCHID>

<PWCLIENTID>{clientId}</PWCLIENTID>

<AUTHCODE>123456</AUTHCODE>

<CVVCODE> </CVVCODE>

<PAYMETH>C</PAYMETH>

<PWUNIQUEID>189899</PWUNIQUEID>

<AHNAME>Sample Name</AHNAME>

<AMOUNT>10.00</AMOUNT>

<MACCOUNT>XXXXXXXXXXXX0016</MACCOUNT>

<CCTYPE>CUP</CCTYPE>

<PWTOKEN>XXXXXXXXXXXXXXXXXXXX</PWTOKEN>

<PWCUSTOMID2>000000223154</PWCUSTOMID2>

<PWINVOICENUMBER>20210170128760201</PWINVOICENUMBER>

<CURRENCY>USD</CURRENCY>

</PAYMENTRESPONSE>

Non-Secure Plus Token Sale Request Example:

Use the Token and PWUNIQUEID from the above finalize transaction response

Debit card is not allowed to process Non-SecurePlus payments. Union Pay will return decline in prod for debit cards.

<?xml version="1.0" encoding="UTF-8"?>

<PAYMENTREQUEST>

<TRANSACTIONHEADER>

<PWVERSION>3</PWVERSION>

<PWCLIENTID>{clientId}</PWCLIENTID>

<PWKEY>{key}</PWKEY>

<PWUSER>{username}</PWUSER>

<PWPASS>{password}</PWPASS>

<PWTRANSACTIONTYPE>SALE</PWTRANSACTIONTYPE>

<PWSALEAMOUNT>10.00</PWSALEAMOUNT>

<PWINVOICENUMBER>testcup200504002</PWINVOICENUMBER>

</TRANSACTIONHEADER>

<CUSTOMER>

<POSINDICATOR>R</POSINDICATOR>

<PWUNIQUEID>192824</PWUNIQUEID>

<PWMEDIA>CC</PWMEDIA>

<PWTOKEN>3DD22D8DF80A4FB57360</PWTOKEN>

</CUSTOMER>

</PAYMENTREQUEST>

Non-Secure Plus Token Sale Response Example:

<?xml version="1.0" encoding="UTF-8"?>

<PAYMENTRESPONSE>

<RESULT>APPROVAL</RESULT>

<BATCHID>691</BATCHID>

<PWCLIENTID>{clientId}</PWCLIENTID>

<AUTHCODE></AUTHCODE>

<CVVCODE> </CVVCODE>

<PAYMETH>C</PAYMETH>

<PWUNIQUEID>192824</PWUNIQUEID>

<AMOUNT>10.00</AMOUNT>

<MACCOUNT>XXXXXXXXXXXX0016</MACCOUNT>

<CCTYPE>CUP</CCTYPE>

<PWTOKEN>3DD22D8DF80A4FB57360</PWTOKEN>

<PWCUSTOMID2>000000223154</PWCUSTOMID2>

<PWINVOICENUMBER>testcup200504002</PWINVOICENUMBER>

<CURRENCY>USD</CURRENCY>

</PAYMENTRESPONSE>

Sending a UnionPay payment transaction to the gateway is a two-step process using two distinct transaction types consecutively: INITIALIZE and FINALIZE.

INITIALIZE - Initiate the SMS authentication request. The developer needs to pass the card number, expiration date and the phone number via the tags below. In the INITIALIZE response, there will be an additional field: ISDEBIT=TRUE/FALSE that indicates if the card is a credit or debit card.

FINALIZE - Complete the CUP transaction with the unique ID from the INITIALIZE response. The SMS Code sent to the customer's mobile phone needs to be passed via the SECURECODE tag. If the card is a credit card (read from the INITIALIZE response), then the CVV2 is mandatory.

UnionPay also supports two other transaction types: VOID and CREDIT for voiding transactions prior to settlement or refunding transactions after settlement. The syntax for these transaction types is the same as specified elsewhere in this document.

Initialize Request Parameters

| Parameter | Required | Type | Description | Validation |

|---|---|---|---|---|

| PWVERSION | ✓ |

int | The Paywire Gateway version number. | 3 |